2021-10-6 12:55 |

Bitcoin markets have started to decouple from stocks as ominous October signals loom bearish for major exchanges.

The bullish weekend activity for markets for bitcoin and its brethren has seen crypto assets decouple from stock markets, which took a heavy tumble late last week.

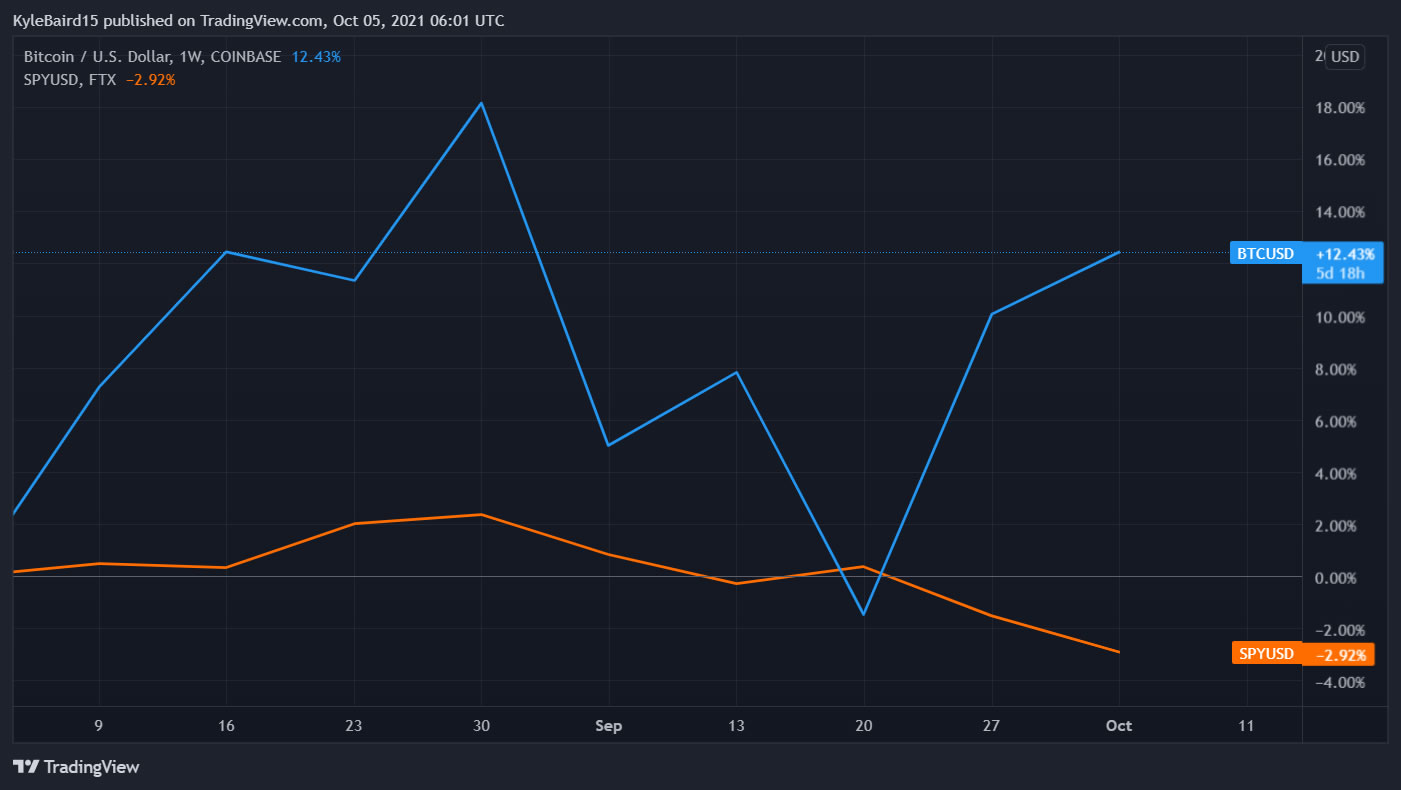

Bitcoin vs S&P500Bitcoin prices have been steadily climbing since the bottom of the correction which dropped prices to just below $30,000 on July 21.

BTC prices finally retouched $50,000 on Oct 5, marking a recovery of 66% from the local bottom. Conversely, the S&P 500 Index started trending downwards in early September and has lost around 5.2% since its all-time high of 4,536.95 on Sept 2.

BTC vs S&P500 Chart – TradingViewThe chart shows the divergence which really became evident in late September as the stock index continued to decline.

October pain for stocksPopular crypto trader and analyst going by the Twitter pseudonym ‘The Wolf Of All Streets,’ observed the action late last week when stocks continued their bearish selloff.

“Stock market got absolutely hammered today. But Bitcoin is up. Beautifully uncorrelated asset.”

The recent social media platform outages did not help stock prices for the tech giants which dominate the S&P 500 Index. The Nasdaq also closed at its lowest level since June 22 on Monday and could be headed for a test of its long-term 200-day moving average.

October is traditionally a bearish month for stock markets, a narrative which could be exacerbated by the fact that stocks have been extremely bullish, hitting new highs for the first eight months of the year.

According to Market Watch, October is the most volatile month for stocks and when markets suffered their two worst crashes in U.S. market history. Analysts are already using the term “Black Swan” to describe what could be in store for stocks this month.

Store of value assets such as Bitcoin and gold usually perform well when stock markets tumble. Bitcoin guru analyst ‘PlanB’ is still convinced that there is a lot further to go in the current Bitcoin bull market. In an update to his famous stock-to-flow model over the weekend, PlanB stated:

“My guess: this 2nd leg of the bull market will have at least 6 more months to go.”

Gold price outlookGold is another store of value asset that usually performs well when shares are tumbling. Gold has been down-trending since its August 2020 all-time high of $2,070/oz but it appears to have bottomed out around $1,700/oz and could be heading upwards again.

At the time of press, the precious yellow metal was trading at $1,755 according to GoldPrice. A quick move to resistance at $1,900/oz would be likely if the bourses get battered over the coming weeks.

The post Bitcoin Decouples From Stock Markets as October Pain Looms appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|