2023-1-24 19:48 |

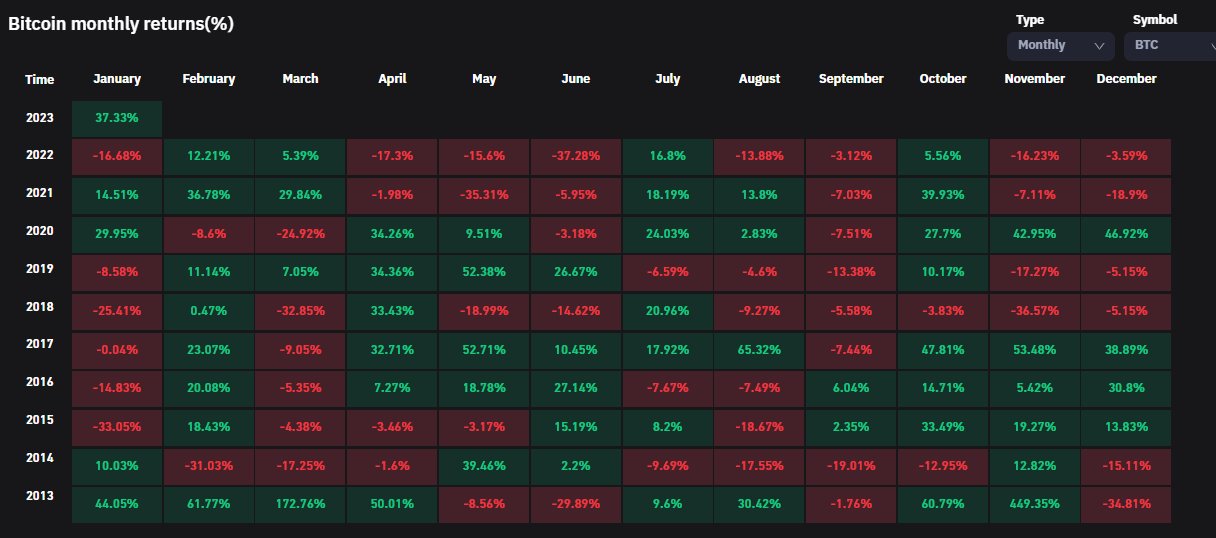

Bitcoin (BTC) has shown the highest return since October 2022 and has the best January in 10 years in monthly returns.

BTC Yearly ReturnsSince the start of the year, BTC has enjoyed remarkable growth from $16,583.18 to $23,060.14 as of press time – amounting to about 39% return in 23 days.

Over this month, the economy has grown across multiple sectors, with gold and the S&P500 up 19% and 13%, respectively, since last November. BTC has established itself as an important part of investment portfolios while experiencing outstanding price rallies.

However, since the coin exceeded over $69k in November 2021, BTC has struggled for stability. For most of 2022, BTC plummeted owing to macro factors in the global market, insolvencies, and controversies rocked the industry. The coin with the highest market cap lost a significant portion of its value, dipping to $15,700 last November.

Possible factors behind the recent price rallyCrypto whales are likely behind the price surge, according to recent market research by Kaiko. As revealed, trade sizes have increased on Binance, which reflects that Whales are gaining confidence in the market.

Likewise, inflation is slowing down in the U.S. after a series of combative measures from the Fed. The consumer price index decreased 0.1% in December every month, consistent with Dow Jones estimates.

Further, as bitcoin prices have dropped, several miners have been forced to leave the industry. Miners often accumulate massive amounts of digital currency, which makes them some of the biggest sellers. When miners sell off their bitcoin holdings to pay off debt, they remove much of the remaining selling pressure.

Furthermore, Bitcoin’s upcoming halving sometime between March and May 2024 could provide traders with some excitement for New Year’s.

What the Future holdsWhile attention is presently on the next Fed meeting, experts are watchful that the outcome of the meeting can make or break the bull run of BTC. Due to next year’s halving event for BTC, they believe things will improve for BTC in the future.

When the halving events took place years ago, the price of BTC soared. The last event, which took effect in 2020, saw BTC soar from $8,821 to $10,943 within 150 days. Mostly, the crypto community viewed the halving event to have a remarkable impact on the price of BTC as it helps to contract supply and increase its value.

Professor Carol Alexander of the University of Sussex told CNBC in December that bitcoin will see a “managed bull market” in 2023, reaching $30,000 in the first quarter and $50,000 in the second.

According to a CryptoSlate analysis of Bitcoin (BTC) metrics, the market has reached its bottom as investors continue accumulating BTC and pushing illiquid supply to 80%.

Bitcoin’s current market cap stands at $445.58 billion – up from 407.38 billion a week ago.

The post Bitcoin continues price rally, posts best January returns since 2013 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

BestChain (BEST) на Currencies.ru

|

|