2023-7-14 20:00 |

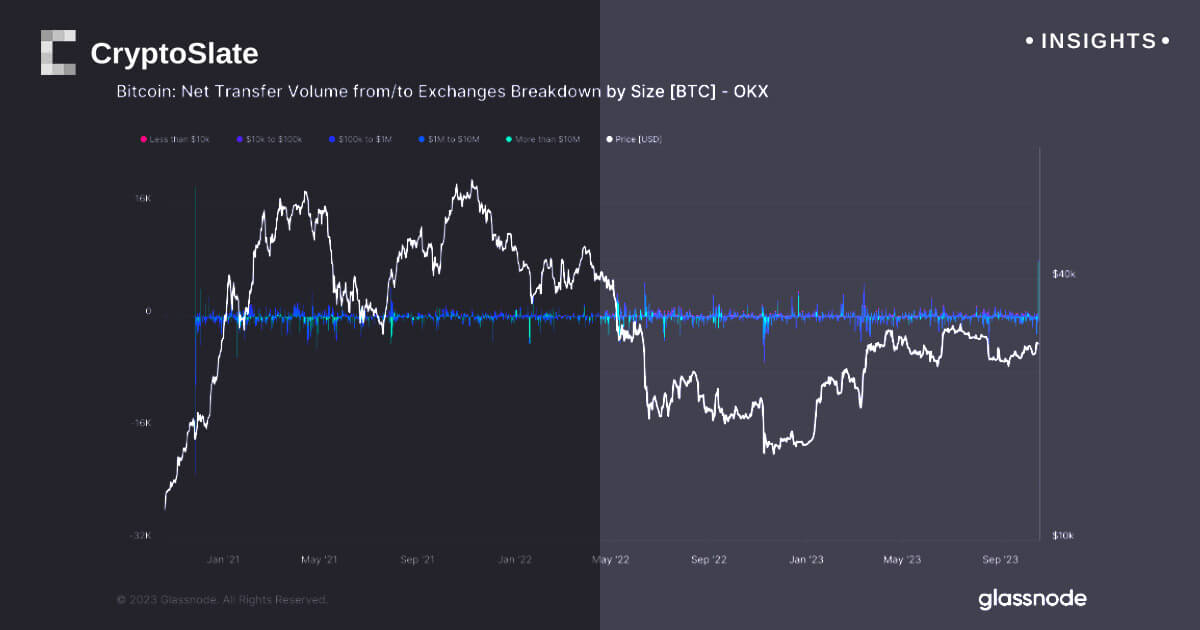

In the context of the volatile Bitcoin market of the past year, a key trend identified in previous CryptoSlate analyses has emerged: the rapid increase in exchange withdrawals for Bitcoin since November 2022. According to Glassnode, this trend has gathered pace since April 2023, resulting in over 100,000 BTC being withdrawn from exchange balances since April 18.

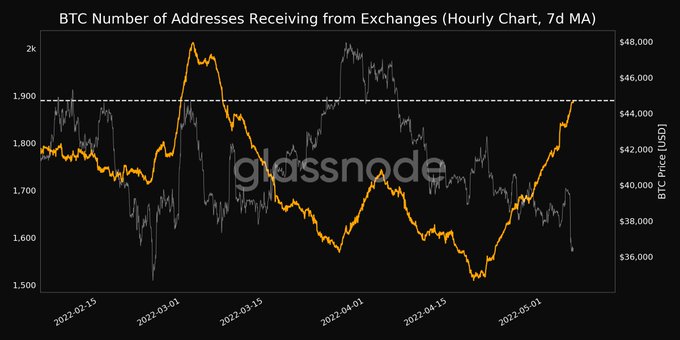

Graph showing Bitcoin’s balance across all exchanges from July 2022 to July 2023 (Source: Glassnode)Understanding the balance of Bitcoin on exchanges is crucial for gauging market sentiment. Increased deposits typically signal a potential sell-off as investors move their Bitcoin to exchanges to liquidate. Conversely, increased withdrawals often indicate a bullish sentiment as investors move their Bitcoin off exchanges for holding or usage, reducing the available supply for trading.

The rate at which Bitcoin is being withdrawn from exchanges has exceeded the rate of deposits since the middle of May 2023. The 30-day change of the supply held in exchange wallets shows that the amount of BTC has decreased by 51,903 BTC. In other words, 51,903 more Bitcoins were withdrawn from exchanges than were deposited during this period. This is a significant shift, indicating a strong trend of Bitcoin moving out of exchanges.

Graph showing Bitcoin’s exchange net position change in 2023 (Source: Glassnode)This rapid pace of withdrawals, coupled with a lack of new deposits, could amplify buying pressure for Bitcoin.

This is evident when analyzing the exchange volume momentum, a metric that compares the monthly average of combined exchange inflows and outflows to the yearly average.

When the monthly average surpasses the yearly average, it indicates an expansion in exchange-related on-chain activity — a sign of increased investor interest in Bitcoin and growing network utilization. Conversely, a higher yearly average signals a contraction in exchange-related on-chain activity, indicative of lower investor interest and declining network utilization.

Graph showing Bitcoin’s exchange volume momentum from July 2022 to July 2023 (Source: Glassnode)As of June 12, the monthly exchange-related volume crossed the yearly average and has continued to rise throughout July. This suggests an increase in investor interest and network utilization, which, combined with the aforementioned withdrawal trends, could potentially increase buying pressure for Bitcoin.

The post Bitcoin buying pressure could surge amid rising exchange withdrawals appeared first on CryptoSlate.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|