2019-4-13 10:12 |

Bitcoin [BTC] is presently riding a major bull wave, with the resistance level, the 200-MA level, and even the $5,000 mark crossed all in one week. However, some are questioning the longevity of this wave. Weiss Ratings, the crypto-specific ratings company, is in the news after it pessimistically pointed out that a pullback is imminent.

According to their April 12 tweet, Weiss predicted that Bitcoin will drop down to $4,000, a price it was last trading at on March 26. Crediting their “model,” while providing no supporting metrics or parameters, the crypto-community turned on Weiss and did not respond positively to their bearish claims.

Weiss’ prediction would mean a 21.87 percent drop in the price of the coin, much higher than their daily gain of 17 percent on April 1, which set-off the aforementioned price rally. Given Bitcoin’s hold on the collective market, a drop of this proportion could spell doom for the entire coin market.

Following the coin’s rapid price ascendance and the fever of a possible bull run, BTC purchases are currently through the roof. Citing support at $5,000, Weiss added that the market was “short term overbought.”

Weiss Ratings’ full tweet read,

“#BTC dips below $5K, but back up. Support is holding at $5K and its pulling other #cryptos up as well. The market is short term overbought, and our model has been pointing to a pullback to the 4,000’s. #crypto.”

The crypto-rating agency’s claim comes on the back of the first correction since the April rally began. After reaching a high of over $5,420, the king coin dropped by a massive 8.51 percent, and plummeted below the $5,000 mark on April 12.

Despite the $5,000 drop being brief, it triggered a host of analysts stating that this correction was the first of many. Several predicted that the bottom would be re-visited given the rapid nature of the Bitcoin price push.

A drop of this proportion would certainly drag down the hopes of the collective cryptospace and would add to opposing claims that the cryptocurrency market is rife with volatility. Furthermore, with the SEC stating that volatility is the prime reason behind the stalling of a decision on the publicly traded Bitcoin product, the Bitcoin ETF proposal scheduled for May 2019 would be delayed once again.

The community might not take Weiss at its word though, given the past comments they’ve made with reference to market prediction. Immediately after the price rally ensconced the market, Weiss stated that they had informed their “premium subscribers” that the bear market was “officially over,” crediting their “model” yet again.

Even then, Weiss did not provide any proof of intimation of the stated information or market study data with indicators to back their claims. Additionally, users hit back, calling Weiss’ bluff, stating that the point of the prediction was to make it before-the-fact, and not after it.

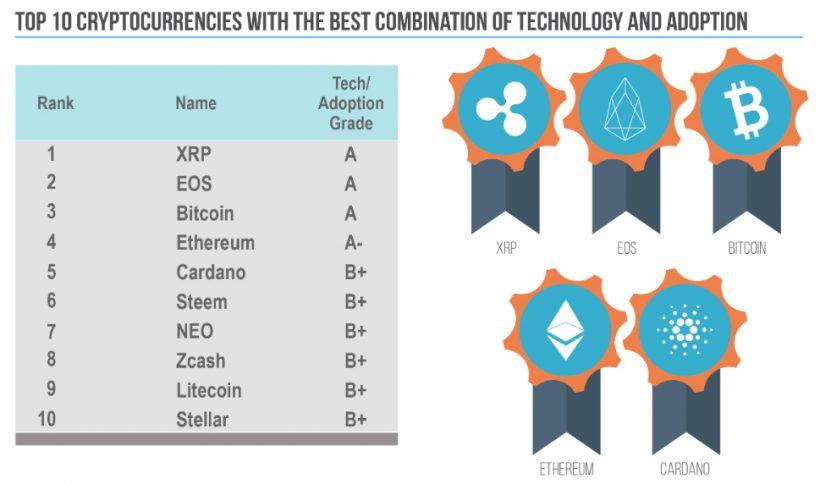

Two coins that Weiss pegged as being reliable both on a long-term and short-term basis were EOS and XRP. However, market results beg to differ. XRP has held firm with several adoption cases, while EOS has seen its market cap and position on the coin ladder fall.

EOS, took the top spot for risk-return and finished second, behind XRP, on the technology and adoption metric, in the Weiss Ratings’ chart. Since then, EOS has seen Litecoin [LTC] and Bitcoin Cash [BCH] overtake it. At press time, the crypto pegged to be a “competitor to Ethereum,” is languishing in the sixth spot, behind BCH by over $170 million.

The post Bitcoin [BTC] will drop to $4,000; market is “overbought,” suggests Weiss Ratings appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|