2021-1-6 13:46 |

JPMorgan says Bitcoin could reach $146,000 in the long term as it competes with Gold as an asset class

Investment banking giant JPMorgan predicts that Bitcoin’s price could reach $146,000 in the long term as the leading cryptocurrency competes with Gold as an asset class. JPMorgan made this prediction based on the assumption that Bitcoin will continue to grow in popularity as an alternative to the precious metal.

JPMorgan strategists, led by Nikolaos Panigirtzoglou, told Bloomberg that Bitcoin’s current market cap has to increase by 4.6 times to achieve the target price of $146,000. At that price, Bitcoin could compete with the private sector investment in Gold which is carried out via exchange-traded funds (ETFs), bars and coins.

While the strategists believe funds could move out from the Gold market into Bitcoin, they argue that BTC’s volatility doesn’t help its case with several institutional investors. “A convergence in volatilities between Bitcoin and Gold is unlikely to happen quickly and is in our mind a multi-year process. This implies that the above $146,000 theoretical Bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year”, the strategists said.

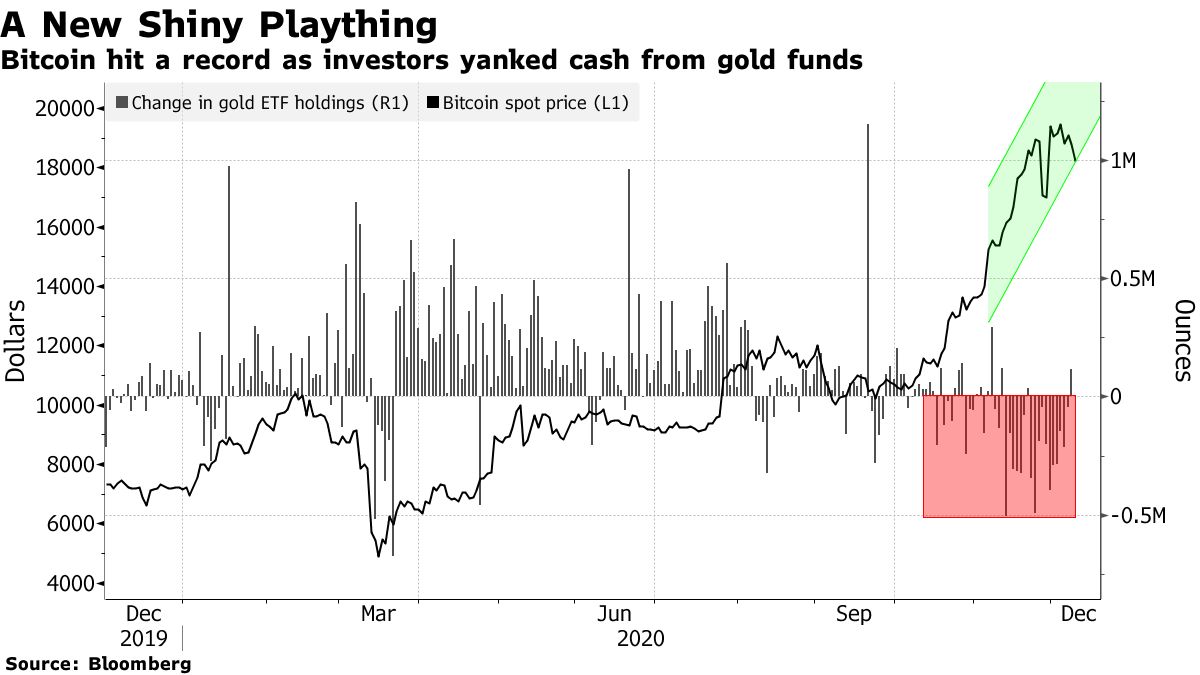

Last month, JPMorgan strategists aired their views on Bitcoin and Gold. According to them, Bitcoin’s adoption is coming at the expense of Gold as billions of dollars leave the Gold market and enter into Bitcoin.

Over the past year, Bitcoin is up by over 400%, continuing its massive rise after ending 2020 trading above $29,000. Earlier this week, Bitcoin dipped by nearly 17%, its most significant decline since March 2020. The analysts believe that the volatility is a hindrance for numerous institutional investors looking at Bitcoin as an alternative asset class.

Although the cryptocurrency community expects the current rally to continue, JPMorgan envisions a speculative mania and believes the market would struggle to sustain massive gains. “While we cannot exclude the possibility that the current speculative mania will propagate further pushing the Bitcoin price up toward the consensus region of between $50,000—$100,000, we believe that such price levels would prove unsustainable”, the strategists added.

The volatility hasn’t hindered numerous institutions and notable investors from allocating funds into Bitcoin. Popular investors like Paul Tudor Jones, Scott Minerd and Stan Druckenmiller have allocated funds into Bitcoin or plan to do so. MicroStrategy, Skybridge, Square, Guggenheim and a host of other institutional investors are also entering the Bitcoin market or increasing their positions.

The post Bitcoin (BTC) could reach $146k in the long term: JPMorgan appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

3X Long Bitcoin Token (BULL) на Currencies.ru

|

|