2019-7-2 11:22 |

Coinspeaker

Binance Enables Cryptocurrency Futures Trading

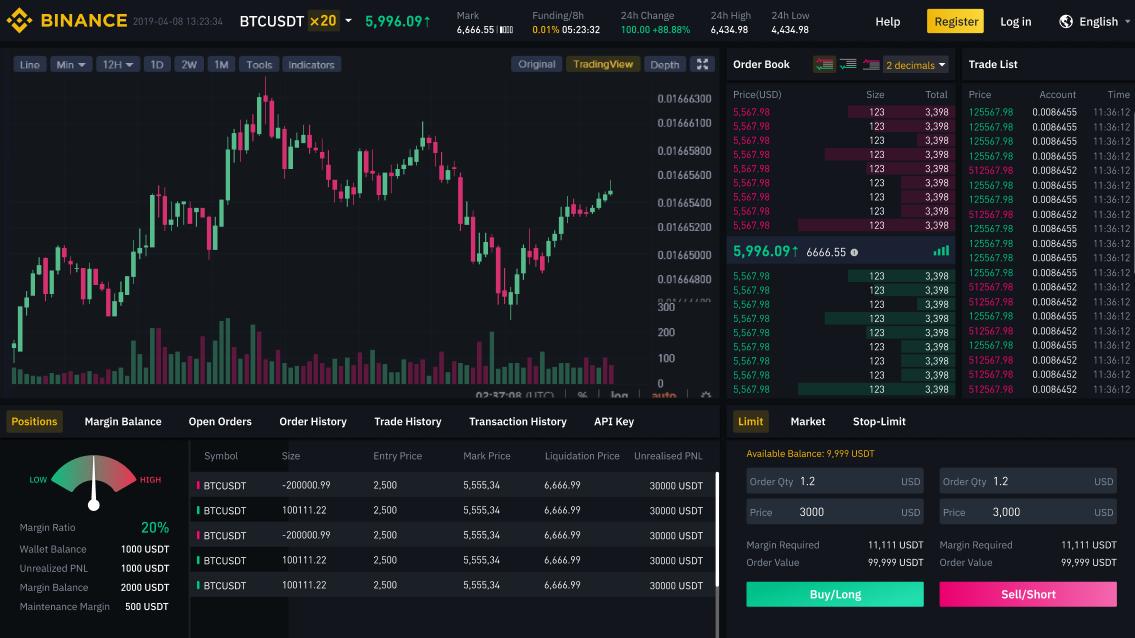

World’s largest cryptocurrency exchange by trading volume, Binance decided to enable cryptocurrency futures trading. During a presentation at the Asia Blockchain Summit in Taipei on Tuesday, its founder and CEO, Changpeng Zhao, explained a futures trading interface on Binance with features including longs and shorts on crypto assets. He said:

“Binance will be launching a futures platform very soon. I don’t have the exact date yet. The simulation test version will be live in a few weeks.”

Speaking of the screenshot of the interface showed on the stage, Zhao also said that “this” was an actual screenshot of the working system. He said that the “Binance futures is coming.”

In one of his slides he explained that the leverage could be up to 20 times and will be offered for trading on Bitcoin initially. Even though he didn’t reveal a releasing date of the feature, persons involved in the case say that there will be a test launch in about two weeks from now.

This is quite big news if we we consider that the company is constantly rolling out new trading pairs and features for its non-custodial trading platform, Binance DEX – most recently two new stablecoin trading pairs.

Also, let’s not forget that on June 21, BTC futures pioneer Chicago Mercantile Exchange (CME) Group reported that open interest in its Bitcoin (BTC) futures contracts had hit an all-time high, with contracts spiking at a $1.7 billion in notional value by June 28.

Be it as it may, the platform is expected to compete with the incumbent and largest derivatives exchange by volume, BitMEX. And if we look at the Binance’s position as the world’s most popular crypto-to-crypto exchange by volume, we can easily claim that this wont be (for BitMEX) an easy war to win.

More sophisticated trading products could have other benefits for the market. Fund manager and Bitcoin advocate Anthony Pompliano said:

“More sophisticated products. More liquidity.”

As far as we know and based on the slides Zhao showed, there will be support for only Bitcoin (BTC-USDT). Also, leverage will initially be up to 20X. Eventually, support will be offered for higher leverage as well as more pairs.

Here is the new Binance 20x futures product. Catch more about it on my interview with @cz_binance . Unbelievable stuff. pic.twitter.com/rPuyzU3mjS

— Ran NeuNer (@cryptomanran) July 2, 2019

Amazing to see that @cz_binance says that the highest pressure period of his life was when his token holders were losing money after the BNB ICO.

I wish more founders had the same ethic and value system. pic.twitter.com/1brtedI0NS

— Ran NeuNer (@cryptomanran) July 2, 2019

Cryptocurrency trader and analyst Luke Martin broadly categorized exchanges based on their service offerings. He thinks that Binance is entering every major segment. He tweeted:

Crypto exchange types:

1/Derivatives: margin, swaps, futures (Bitmex, Bybit, Deribit)

2/Regulated: BTC & major alt focus, fiat on-ramps (Coinbase, Gemini)

3/Unregulated: Alt focus (Binance, Kucoin)

4/DEX

Binance adding futures & becoming only exchange to be in every category. https://t.co/Ikp9pwOtyv

— Luke Martin (@VentureCoinist) July 2, 2019

Let’s just mention that this platform will first support a Bitcoin/Tether pair (BTC/USDT) with up to 20 times leverage. More pairs, as well as higher leverage, will be added in the future.

Estimated notional value of CFTC regulated Bitcoin futures (combined CME and CBOE historical values) has surged more than 270% since 1Q19, vs. a 150% increase in the price of Bitcoin. Total reportable CFTC Bitcoin futures traders are still almost half the number of total traders a year ago and sit below 50 in total.

Currently there are 4 asset managers/institutions with active positions on the product on a quarterly basis, with hedge-funds, prop-trading shops, and other traders making up the bulk of active traders

The concentration of the largest Bitcoin futures traders as a percentage of the total open interest notional value doesn’t paint a better picture. In fact, this past week the top four largest short traders made up 75% of the total outstanding notional value, an all-time high.

Binance Enables Cryptocurrency Futures Trading

origin »Filecoin [Futures] (FIL) на Currencies.ru

|

|