2020-10-8 16:14 |

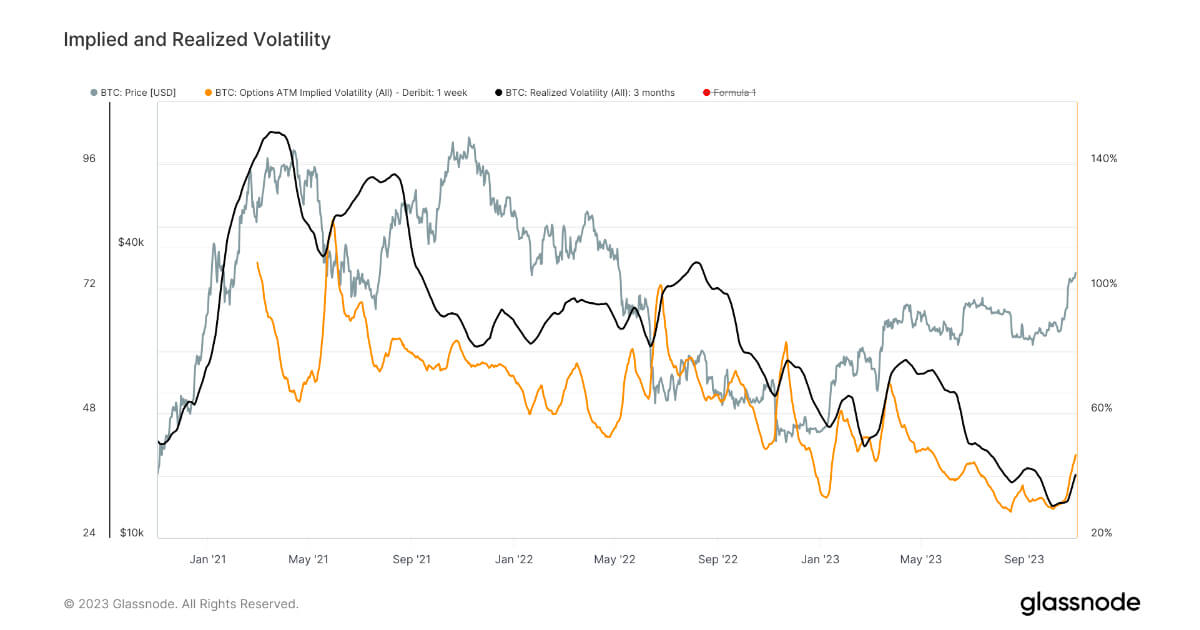

Bitcoin strategists are waiting for a bias-defining price move as the cryptocurrency’s historical volatility falls to its lowest in three months.

Jan Uytenhout, the co-founder of Capriole Investments in Denmark, iterated the outlook in a tweet issued earlier this Wednesday. The fund manager cited old references to show a correlation between the Bitcoin price and its historical volatility index.

He noted that the cryptocurrency undergoes sharp price moves regardless of its direction whenever its volatility falls below 20, based on readings from a technical indicator. For instance, in late July 2020, the BTC/USD exchange rate climbed 11.37 percent, just as its volatility dipped below 20. The chart below illustrates it.

Bitcoin chart showing its price-volatility correlation. Source: TradingView.com Bitcoin chart showing its price-volatility correlation. Source: TradingView.comIn another instance, the pair dived lower by 12 percent on a lower volatility alarm.

Bitcoin Bias-ConflictIn retrospect, Historical Volatility works least when it comes to predicting future price trends. At best, it merely shows how far an asset has moved away from its moving average price. That shows how even a healthy and trending market can undergo dramatic changes in prices over time amid low volatility periods.

But for traders, a period of low volatility reflects an asset’s inability to return tremendous profits in a short time. That prompts them to seek yields elsewhere or wait for more significant traders to buy the asset en masse, thereby pushing the prices higher.

That partially explains why the Bitcoin market post giant upside/downside candles when its volatility slips into the yellow region, as shown in the chart above.

As the cryptocurrency’s bias conflict remains, traders are now looking at other major market catalysts to guess its next price direction, staring with the ongoing macroeconomic fundamentals.

StimulusThe Bitcoin market has realized that the ongoing US stimulus talks are playing a significant role in driving its short-term sentiment. In retrospect, the Democrats and the Republicans have failed to finalize the aid that intends to help American households and businesses impacted by the coronavirus pandemic.

The former wants a $2.3 trillion package so it could extend the help to some majorly-battered US states, as well. Meanwhile, the latter wants to limit the deal to $1.6 trillion. After two months of negotiations, the conversation stands stuck also as the US presidential election approaches on November 3.

The New York Times has called it a “dangerous delay” especially when the US job growth has stalled.

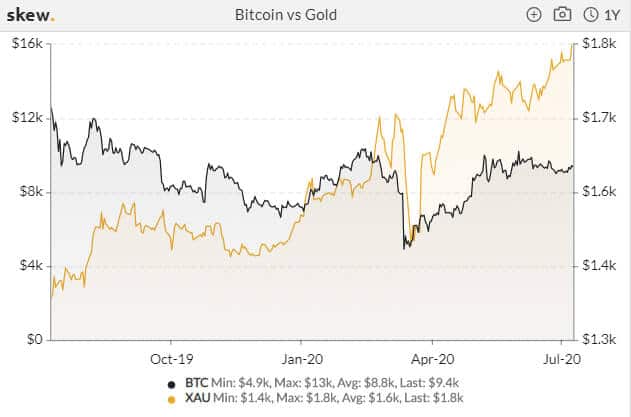

Meanwhile, Bitcoin comes into the picture as a defense against the impact of expensive stimulus packages on the US dollar. Investors expect the greenback to turn lower as it did after the first coronavirus relief of $2 trillion. They, therefore, transfer risks to other assets, which include Bitcoin.

The cryptocurrency rose by more than 200 percent from its mid-March low, especially after the US Congress passed the first relief fund.

But now, with the aid drying up, investors are going back into the US dollar market, dumping bullish assets like Bitcoin at their local tops. In Donald Trump’s own words, there won’t be any stimulus deal until the election. So, the cryptocurrency expects to suffer at least until November 3.

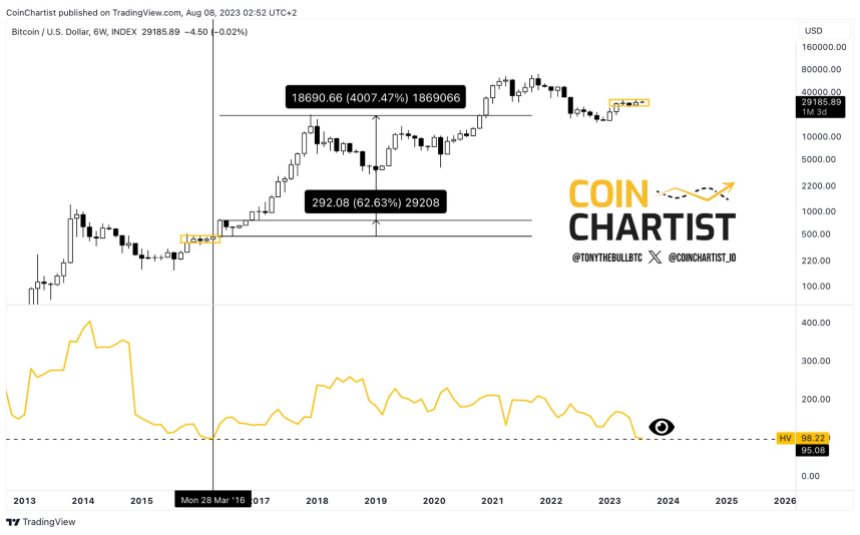

Bitcoin is awaiting a breakout from its symmetrical triangle pattern. Source: TradingView.com Bitcoin is awaiting a breakout from its symmetrical triangle pattern. Source: TradingView.comTechnically, a Symmetrical Triangle formation is also hinting about a big breakdown move in the Bitcoin market. As BTC/USD closes in towards the pattern’s apex, it risks falling by as much as the height of the Triangle. That puts the pair’s downside target somewhere near $9,000.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|