2023-6-29 18:30 |

Crypto, DeFi, and stablecoins, in particular, promised to shake up the global financial system for the better. But they have failed to fulfill this promise, according to a new report from the Bank of Italy. The paper examines the regulatory challenges for the crypto asset market in light of 2022’s severe market turmoil. Its assessment is withering, yet leaves room for optimism.

The 34-page report concludes that crypto and blockchain have “not delivered on its many promises in terms of the efficiency, resilience, and transparency of the financial system.” Although, it does note that “effective regulation” may help achieve these benefits. Including making the financial system more efficient and competitive.

Bank of Italy: Stablecoins Are Not Stable at AllThe report acknowledges that DeFi offers many benefits. Including smart contract automation, atomic settlement, and transparency, enabling quick value transfers with reduced execution risk and fewer intermediaries. However, for all the vaunted potential, the report sees limited practical applications thus far.

Learn the ins and outs of decentralized finance (DeFi) here: How Decentralized Finance Works and Use Cases

The central bank also recognizes the widely acknowledged potential of blockchains (or DLTs) to transform and improve the efficiency of the financial system. But it is careful to distinguish them from cryptocurrencies, which the Bank of Italy says have evolved into more speculative assets in the time since Bitcoin’s creation following the 2008 financial crisis.

The report continues:

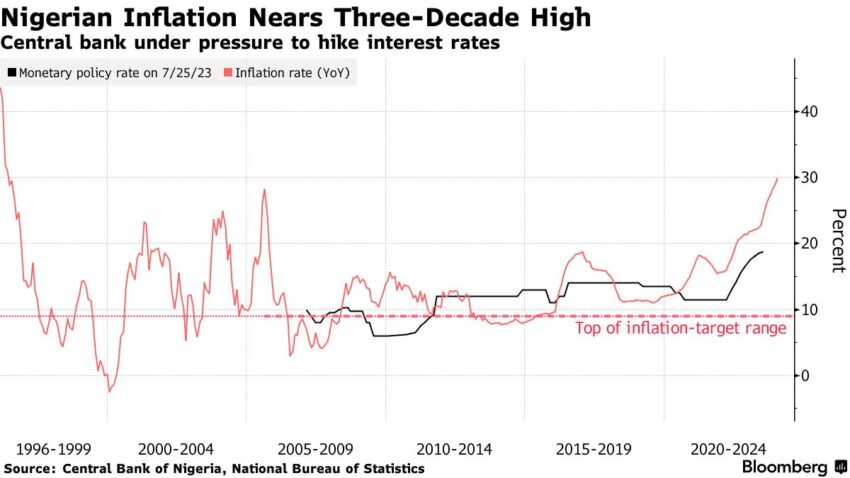

“Indeed, stablecoins – which are sometimes depicted as an efficient alternative in the market for cross-border payments – have not proved stable at all. The rise and fall of many crypto-assets, irrespective of their specific nature and potential economic functions, has been mainly driven by waves of speculation. Market manipulation and insider trading have been frequently observed and holders’ rights are far from certain, as are the tools for enforcing them.”

It warns regulators cannot ignore the crypto assets’ infamous and dangerous boom and bust cycles. Warning that the blurring between traditional finance and crypto poses a risk to financial stability.

Regulators Must Confront “Decentralization Illusion”According to the report, DeFi and crypto’s “decentralization illusion” need to be debunked. It notes that most protocols have core stakeholders that “are able to steer the operations and potentially extract ownership benefits.”

The report makes note of the potential for decentralized autonomous organizations (DAOs) to counterbalance this, but says there should be legal frameworks to better accommodate them.

In addition, the report accepts that regulators and policymakers face difficult decisions. Namely, the need to determine whether to pass regulations specifically for crypto-assets and related services that don’t fit into any existing categories.

DeFi, which “seems at odds with the traditional setup of financial services regulation,” is a particular challenge. Here the choices are crucial, and there is no “one-size-fits-all” option.

The dilemma mirrors what is currently taking place in the United States and other jurisdictions. Currently, the Securities and Exchange Commission (SEC) is attempting to apply existing securities laws to crypto assets. Calls in the industry are growing louder for bespoke rules for the technology.

The post Bank of Italy: Cryptocurrencies and DeFi Have Not Lived Up to Their Promise appeared first on BeInCrypto.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Time New Bank (TNB) на Currencies.ru

|

|