2020-9-14 11:40 |

The past few weeks have seen a slew of new DeFi yield farming clones emerge. Many newcomers like BakerySwap are gravitating away from Ethereum to take advantage of the newly-launched Binance Smart Chain.

The latest in a long line of DeFi doppelgangers is BakerySwap, which claims to make yield farming cheaper and easier for everyone. This is becoming a common theme with the likes of Bee2 and its quadratic voting system which diminishes the power of whales in its governance.

Cream Finance was one of the first to opt-out of Ethereum, choosing instead to launch on Binance’s Smart Chain. BurgerSwap was another recent addition to propel activity on the network over the past weekend. Now BakerySwap is following suit as ETH fees still prove to be the thorn in the side of the DeFi sector.

Another Uniswap DeFi ForkBakerySwap, like SushiSwap before it, is another fork of Uniswap. It appears to be just another DeFi clone, adopting similar token farming and distribution models as those that came before it. There is no pre-mine or pre-sale and only 1% of all of the new BAKE tokens farmed get distributed back to the team.

It claims to be the first Binance Smart Chain automated market maker (AMM) to offer altcoin liquidity pools. The announcement added that the project is taking full advantage of the Binance community by providing arbitrage opportunities among BEP2 and BEP20 tokens that are hosted on Binance or on its decentralized exchange (DEX).

Introducing BakerySwap, an AMM Dex on Binance Smart Chain https://t.co/yBEzrCmFXF

— BakerySwap (@bakery_swap) September 12, 2020

There will be two types of liquidity pools for those earning BAKE token rewards and those earning just a 0.25% share of the trading fees.

The BAKE/BNB pool will be the highest-earner but there will be others such as BUSD/BNB, ETH/BNB, BTC/BNB, DOT/BNB, and LINK/BNB liquidity pools.

Further pushing the Binance agenda, BakerySwap will launch new pools for any of the projects that Binance itself promotes through its Launchpad platform which it uses for IEOs.

There will be a staggered release of BAKE tokens to encourage early liquidity providers and its total supply is 731,745,000.

The first 30,000 Binance Smart Chain blocks will yield 400 BAKE per block and take around a day to produce. The following month will produce 300,000 BAKE, reduced day by day, and for the rest of the year, 73 BAKE per block will be produced on average.

BAKE farming begins on Sept 14, 2020, at 3:59 PM GMT.

Is Binance Eating Ethereum?Everything is looking sunny for Binance, and CEO Changpeng Zhao appears delighted that the platform is eating into Ethereum’s market share:

#Binance Smart Chain (BSC) transaction volume is now 14% of ETH.

BNB market cap is 10% of ETH.

In addition to #BSC, #BNB has a native fast DEX blockchain, burn, discount fees on #Binance, and more… https://t.co/rmrxMhxJvi

— CZ Binance (@cz_binance) September 14, 2020

Transactions on the newly launched Binance Smart Chain spiked to 139,279 on Sept 13, according to BscScan analytics. Ethereum had 1,042,047 total transactions for the same day according to Etherscan.

Zhao also bragged how Binance’s native BNB token has now reached 10% of Ethereum’s market capitalization. BNB has indeed been on a tear lately, driven in part by the company’s huge push into the DeFi sector with its own range of products and incentives for its customers.

BNB has pumped to a 2020 high of just over $32 this weekend, adding around 30% since this time last week. The move has propelled its market capitalization to $4.3 billion at the time of press and has flipped Bitcoin Cash (BCH) in the rankings.

BNB has since retreated slightly to the $30.50 price level to kick off the week.

BNB/USD Chart – TradingViewEthereum has been correcting from its own two-year high and continued to slip over the weekend dropping to $360. ETH market capitalization is around $41 billion at the time of press.

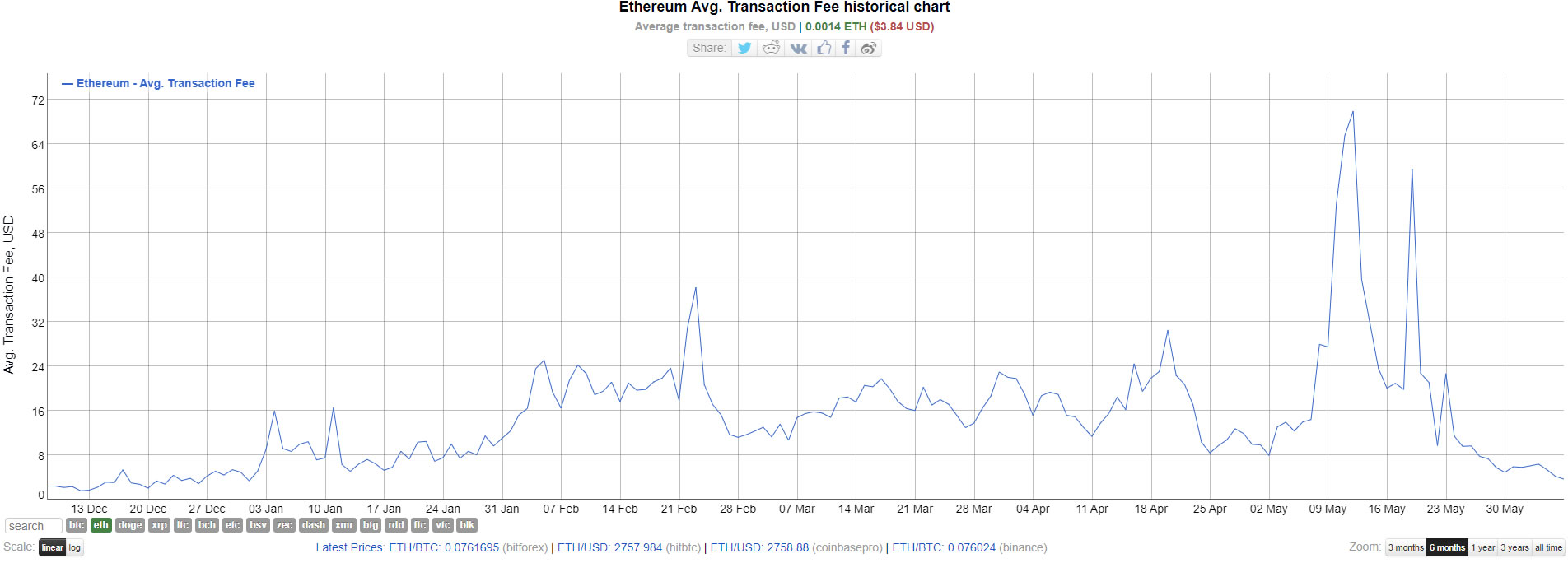

Ethereum Gas Fees Stabilizing But Still HighAs anyone that has used Ethereum over the past month or so will attest, the primary concern with Ethereum is network fees. Average transaction costs peaked at around $15 in early September, making the network financially unviable for the ordinary user at the time.

The two major spikes over the past month were caused by DeFi farming protocols Yam Finance and SushiSwap, as farmers flocked to deposit tokens and grab their rewards.

Since the feeding frenzy has abated, average transaction fees have fallen back to relatively sane levels around $3.30, (120 Gwei on Etherscan).

Ethereum Average Gas Prices – Etherscan.ioThese costs are still relatively high and unless tempered could result in a greater migration away from the network by more DeFi protocols.

The amount of Ethereum locked across DeFi protocols appears to have taken a dive according to DeFi Pulse, which reports a TVL of 3.3 million ETH, a loss of 50% since the same time last week.

The total value locked in USD terms, however, is back up to almost $8.5 billion with Uniswap leading gains over the past 24 hours as its own liquidity approaches the billion-dollar level once again.

The post BakerySwap DeFi Platform Shuns Ethereum, Launches on Binance Smart Chain appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Defi (DEFI) на Currencies.ru

|

|