2023-3-3 05:37 |

Ethereum price retraced slightly after climbing above $1,700 for the first time in six months. Will the recent abstinence among long-term ETH holders trigger another price rally in March 2023?

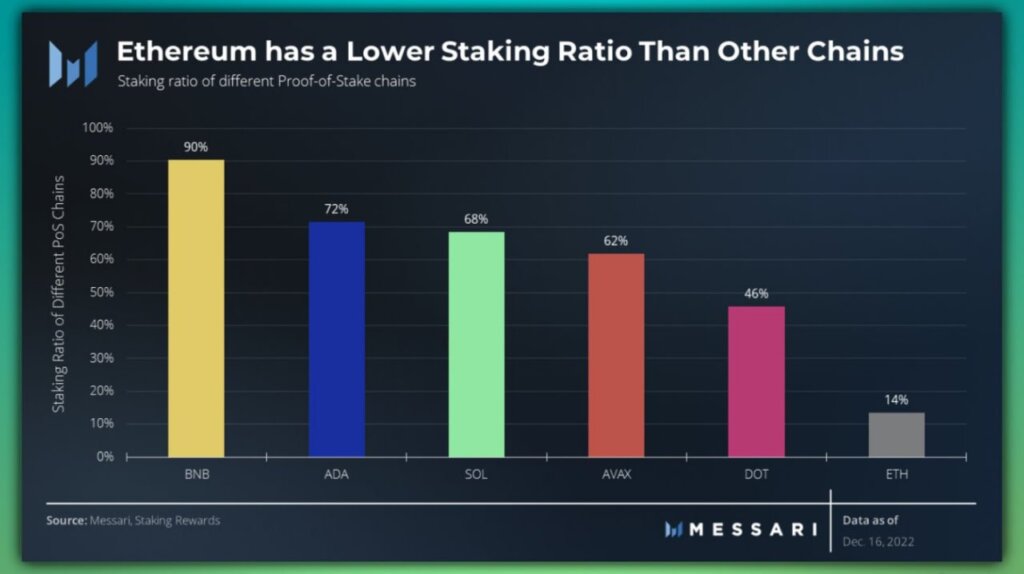

Ethereum Holders Appear to Sit TightEthereum’s (ETH) Shanghai upgrade has been one of the hottest crypto topics in 2023. The scheduled network upgrade is set to enable ETH 2.0 stakers to withdraw nearly 16 million ETH.

This has become the subject of intense price speculation among short-term traders within the Ethereum ecosystem.

However, on-chain Age Consumed data from blockchain forensics firm Santiment has shown that Ethereum long-term holders have continued to hold tight.

Ethereum Age Consumed, March 2023. Source: SantimentThe chart above shows a decline in ETH Age Consumed. This metric depicts the volume of ETH tokens that have recently moved multiplied by the number of days they last moved. Low values of this metric indicate that ETH long-term holders have been placing fewer sell-orders.

Judging by the historical correlation, if ETH long-term holders continue to sit out the recent price speculation, the resulting decline in sell pressure could power a strong March performance.

Notably, the net flow of ETH across prominent exchanges has been in a steady decline since mid-January. This metric measures the difference between the inflow and outflow of ETH across top exchanges.

Ethereum (ETH) Exchange Netflows. March 2023. Source: IntoTheBlockSince hitting a 2023 peak of 108,470 ETH positive netflow on Jan. 14, it has declined steadily to bottom out at a negative flow of 76,000 ETH following the recent successful testnets. Even the recent surge on Feb. 24 has been cooled by two new lows.

Declining values of exchange netflow is a strong bullish signal which indicates that a lesser volume of ETH is available on exchanges to fill up short-term sell orders.

Historically, such downward trends in ETH Netflow have often coincided with previous price booms. And if this condition holds, ETH could be poised to continue the uptrend in March 2023.

ETH Price Prediction: A Test of $2,000Santiment’s market-value-to-realized-value (MVRV 30d) data indicates upcoming bullish price action. Although most holders who bought ETH in the last 30 days are sitting in net-positive positions, the chart below depicts current prices are still far from the usual 20% euphoric profit-taking lines.

As things stand, Ethereum price might be on course to test the $1,950 area. A successful test of price could see an extended rally toward $2,300 where the majority of ETH 2.0 stakers may start to book profits.

Ethereum (ETH) MVRV Ratio. March 2023. Source: SantimentHowever, a dip below $1,450 – which appears to be the historical stop-loss of 13% – could trigger a panic sell-off. This could see ETH decline to $1,300 before testing resistance levels.

The post Assessing Ethereum (ETH) Network Activity Ahead of Shanghai Upgrade appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|