2024-5-10 19:17 |

Fineqia International, a digital asset and fintech investment business, today announced its April Crypto ETPs AUM report.

The company’s monthly analysis of global Exchange Traded Products (ETPs) with digital assets as underlying collateral, revealed a 64% growth in total Assets Under Management (AUM) so far in 2024.

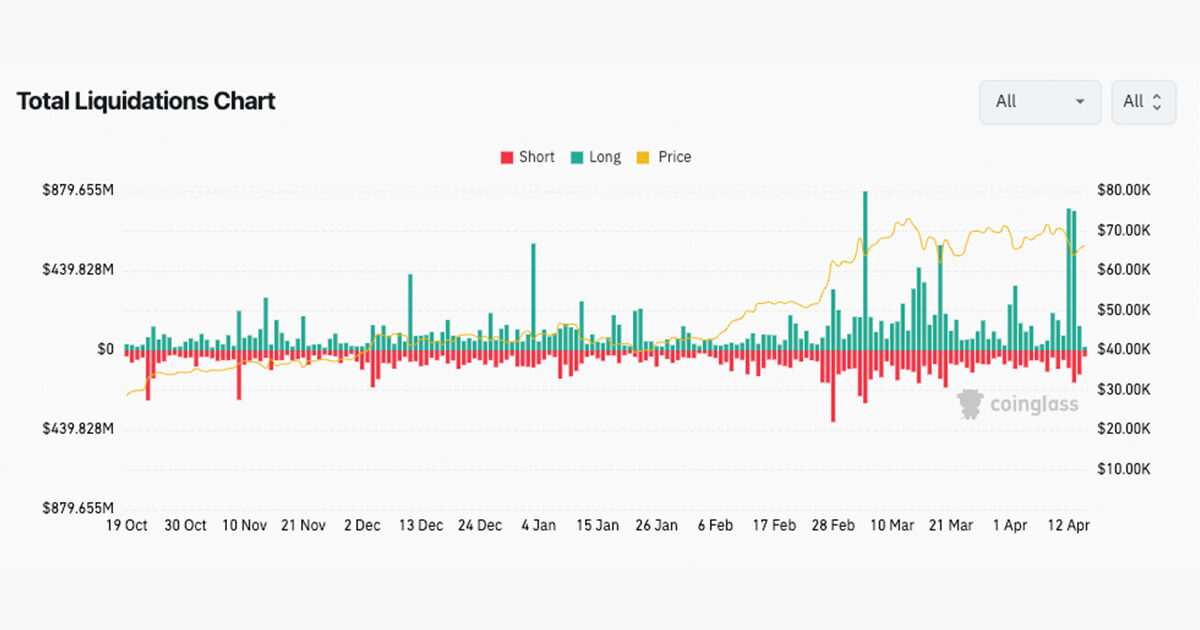

A tough April for cryptosHowever, on a monthly basis, the total AUM dropped to $81 billion in April, from $94.4 billion at the end of March, a 14.2% decrease.

The total market value of digital assets decreased by 18.8% to about $2.29 trillion in April, from $2.82 trillion the previous month.

According to the Fineqia research, ETPs representing a diversified basket of cryptocurrencies decreased 9.5% in AUM during April, to $2.8 billion, from $3.36 billion recorded at the end of March.

However, year-to-date, the AUM of ETPs holding a basket of cryptocurrencies have risen 24.2% from $2.25 billion at the beginning of 2024.

Too expensive thanks to BTC?This could partially be attributed to the relative expensiveness of crypto ETPs currently. As Fineqia notes:

Even amid the market decline, financial products backed by digital assets maintained a 24.5% premium over the digital assets market, consistent with the trend seen in Q1. This year-to-date, ETPs holding digital assets rose 64% in AUM, while the digital assets market cap increased by 29.2%. This highlights a premium growth for ETPs of approximately 117% in comparison to the relative underlying.”

Unsurprisingly, Fineqia attributes this surge in premium predominantly to the approval of Bitcoin (BTC) Spot ETFs in the U.S., which commenced trading on Jan. 11, stimulating capital inflows into financial products featuring digital assets as underlying assets throughout Q1.

Bundeep Singh Rangar, CEO of Fineqia, says that Hong Kong has recently witnessed the launch of crypto ETFs, with the UK poised to follow suit soon. “It’s fully baked now,” he said. “With the initial rise from the SEC’s [approval of BTC ETFs] having cooled off, the loaves are ready and being served on the ETF and ETN shelves across the world.”

Fineqia’s report also highlighted cryptocurrencies doing particularly well and badly in April.

Solana highlightedIn particular, Solana (SOL), comprising almost half of the alternative coins’ total AUM, was praised as “resilient”:

In April, ETPs with SOL as the underlying asset saw a 31.4% decrease in AUM, falling to $1.29 billion from the $1.87 billion recorded at the end of March. During the same period, the SOL price dropped by 37.4%, declining to $127 from the $203 recorded at the end of March. These statistics highlight that the premium observed in April in the AUM of ETPs holding digital assets as underlying compared to the broader digital assets market value can be mainly attributed to the resilience shown by ETPs holding SOL.”

Compare this to Bitcoin, which saw its price decline by 13.6% to $60 150 in April, from $69,650 at the end of March. “Simultaneously,” according to Fineqia, “the AUM of ETPs with BTC as their underlying asset experienced a 13.2% decrease, dropping to $63.2 billion in April from the $72.8 billion recorded at the end of March.”

Ethereum sees near 15% dropMeanwhile Ethereum (ETH) got a less positive report:

In April, Ethereum (ETH) saw a 14.9% decline in value, dropping to $2,985 from the $3,508 recorded at the end of March. During the same period, the AUM of ETH-denominated ETPs decreased by 16.4%, falling to $12 billion from the $14.3 billion recorded at the end of March. Year-to-date, ETPs holding ETH have shown a 26.6% increase, while the ETH price has grown by 31.1%. This emphasizes how the growing expectation among market participants of the SEC rejecting the approval of ETH Spot ETFs in May has led to a decrease in institutional exposure to ETH in favour of BTC.”

The post April crypto report praises Solana (SOL) resilience, doubts Ethereum (ETH) appeared first on Invezz

Similar to Notcoin - Blum - Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|