2022-6-10 01:35 |

The ApeCoin community has approved the proposal to keep the $APE token on the Ethereum blockchain for now, despite some earlier worries about the high cost of transactions on the blockchain.

The AIP-41 proposal was favored by 53.6% of the community, who took to Twitter to share its position.

“ApeCoin should remain within the Ethereum ecosystem, and not migrate elsewhere to an L1 chain or sidechain not secured by Ethereum,” it said.

Voting has ended on Snapshot for AIP-41, to keep $APE in the Ethereum ecosystem for the time being, which the community has approved. You can find the full proposal here: https://t.co/nJQ9Q7kDWM

— ApeCoin (@apecoin) June 9, 2022To date, nearly 3.8 million token holders have rejected Yuga Labs’ earlier demand that called for ApeCoin’s migration to its own chain in order to scale.

We're sorry for turning off the lights on Ethereum for a while. It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale. We'd like to encourage the DAO to start thinking in this direction.

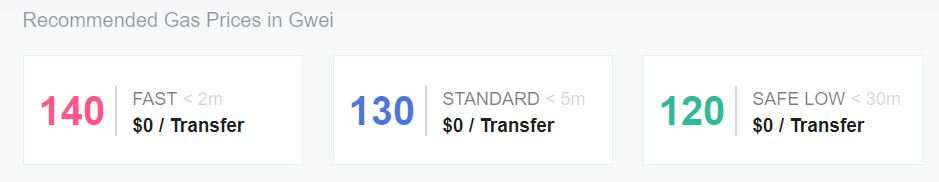

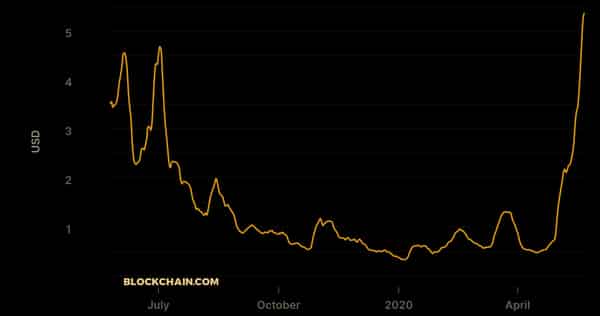

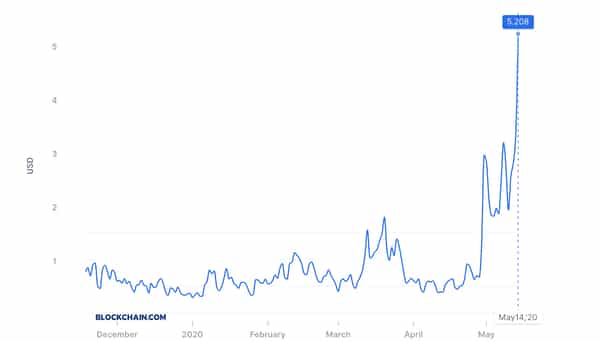

— Yuga Labs (@yugalabs) May 1, 2022 Ethereum’s security “second-to-none”The conversation within the community to move away from Ethereum started in May when users reported “failed transactions” during the mint and sale of Otherdeed NFT. High demand being forced through “Ethereum’s bottleneck” and high fees paid to acquire the virtual land sparked a debate.

The proposal acknowledges that “[m]igrating to a different chain is a costly, risky, and complex endeavor with many moving parts that may, if not thoughtfully considered, result in catastrophic loss, or at worst, abandonment by Yuga Labs and other entities that would otherwise meaningfully to ApeCoin.”

Despite high gas costs incurred on Ethereum, the shift is proving ‘complex and costly’ for the DAO. ApeCoin also added that “Ethereum’s security remains second-to-none” currently, but that doesn’t remove the possibilities of future additions and transitions for the decentralized autonomous organization.

The proposal also stated, “[m]any Layer 2 solutions that are secured by Ethereum, and exhibit meaningful improvement over fees and speed, already exist and could potentially be explored in a future AIP.”

At the time of writing, APE remains the 39th largest token, trading in the price range of $5.6 and $6 on CoinGecko.

Meanwhile, Ethereum has completed the Merge on the Ropsten testnet before the Merge on the mainnet, which is expected this summer.

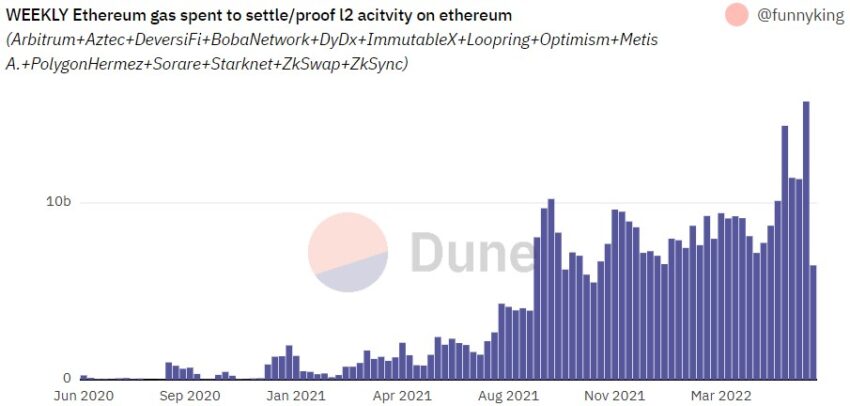

However, since the start of the month, Ethereum continues to record high gas fees. For the month of June, Dune Analytics noted a spike in weekly Ethereum gas spent to settle L2 activities on the blockchain.

Source: Dune AnalyticsWhat do you think about this subject? Write to us and tell us!

The post ApeCoin DAO to Remain on Ethereum Despite High Fees, Scalability Worries appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

High Voltage (HVCO) на Currencies.ru

|

|