2020-6-22 19:31 |

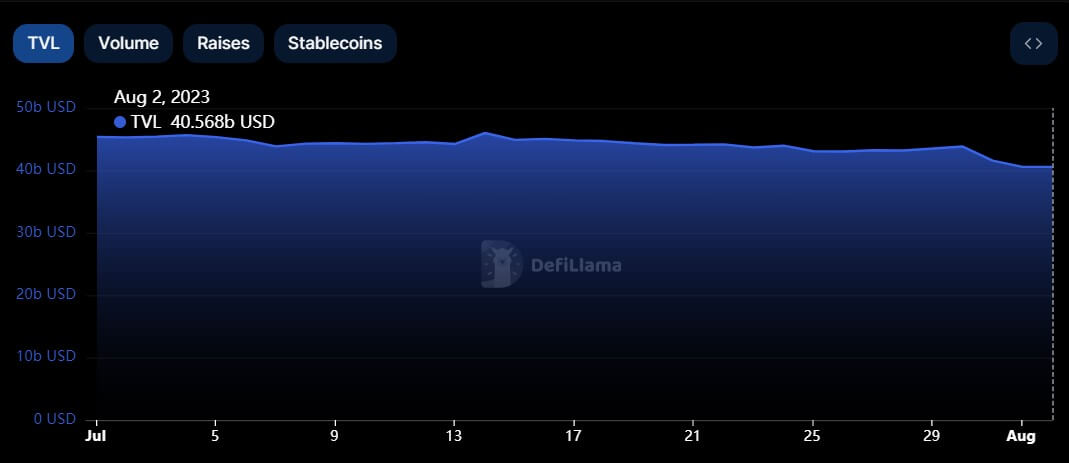

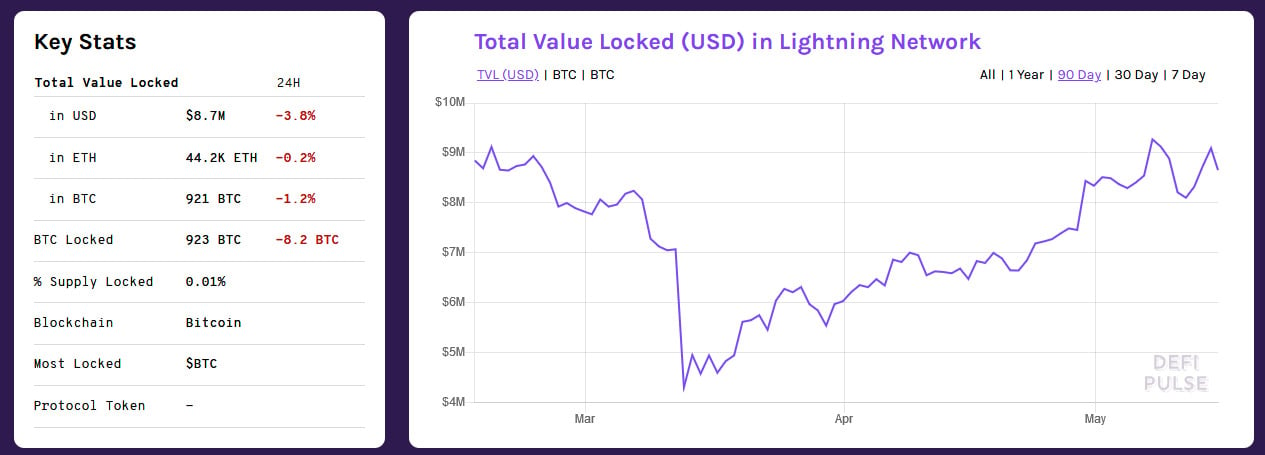

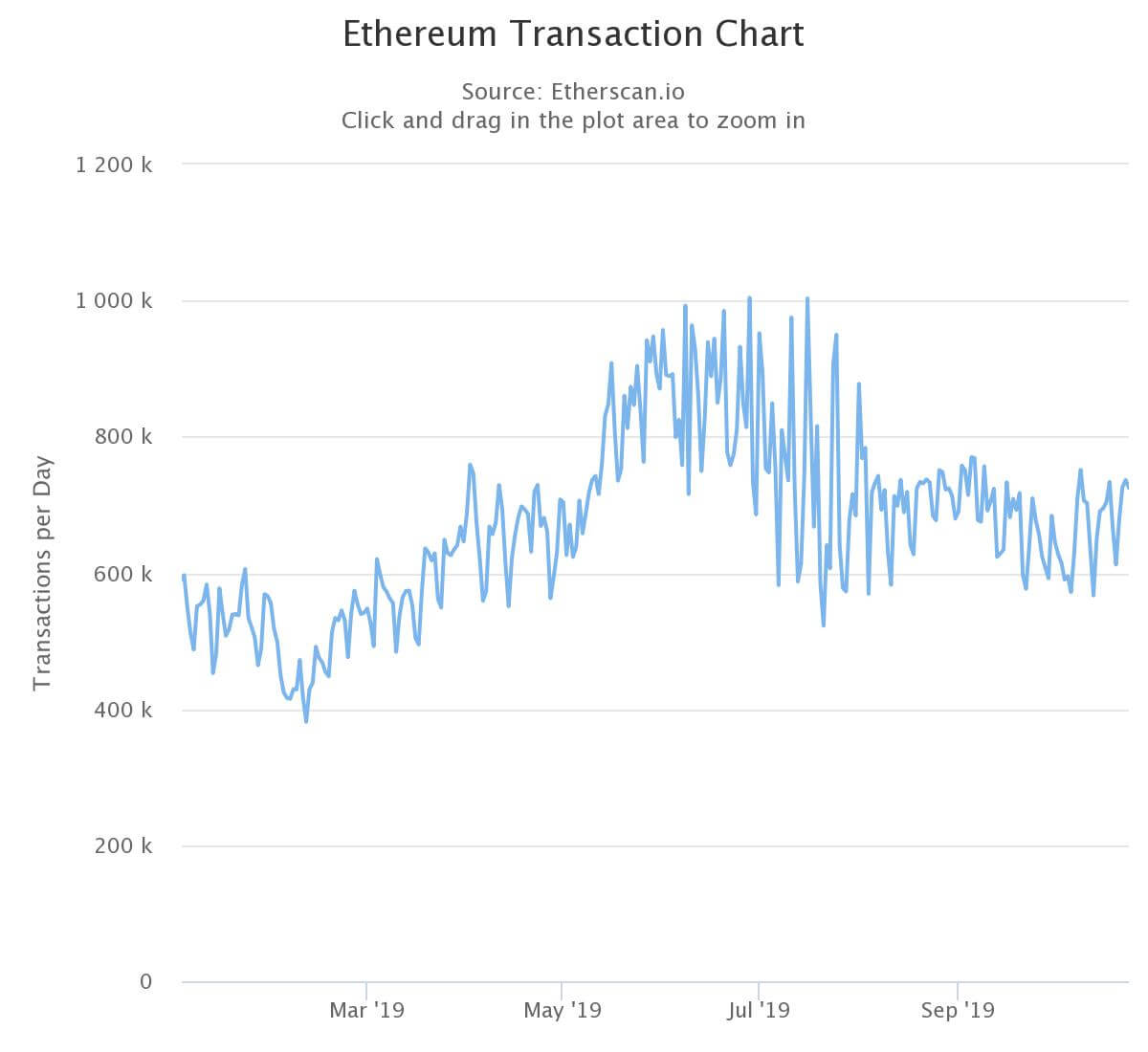

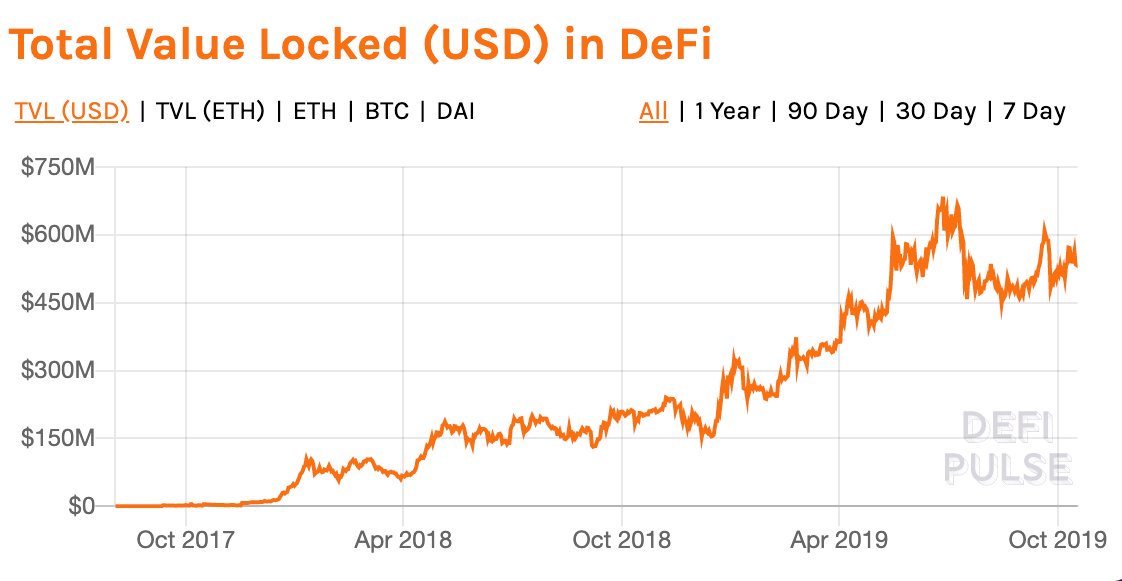

DeFi space has been seeing explosive growth for the past few weeks. The total market cap of DeFi has reached $6.2 billion, as per DeFiMarketCap. Also, the total amount locked in DeFi has hit a new all-time high at $1.50 billion, according to DeFi Pulse.

This surge was the result of people jumping into DeFi tokens after COMP prices shot up over the announcement of its listing on Coinbase Pro, just a couple of days after the initial distribution of Compound Finance’s governance token COMP.

These tokens give the taken holders governance rights to the changes on the Compound platform. They can be delegated but, as of now, gives the holders no financial claim to any of the revenues generated by the project.

Every day 2,880 COMP tokens are distributed in each market 50/50 to both borrowers and lenders. 91% of these tokens are currently going to USDT suppliers and borrowers, said Nick Martitsch, Business Development at Compound. Tether (USDT) has “surpassed ETH to become the largest market on Compound.”

Currently, there is $120 million of outstanding USDT borrowed; this growth has resulted in a downward trend of “COMP earned per $1 borrowed.” The supply and borrow rates for USDT are 12% and 17%, respectively.

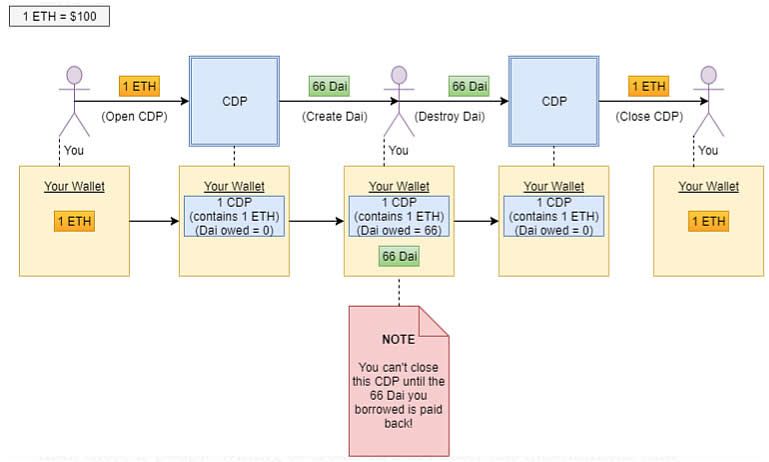

Liquidity miners, meanwhile, are compensated for both lending and borrowing. Which means, “the optimal strategy is to lend the highest interest rate asset, borrow as much as you can against your cAsset tokens (a claim on-lent assets) and then add the remaining assets back into the lending pool,” explained Nelson Ryan, Senior Associate at eblockventures.

Annualized returns are impressive at over 100%, but the interest rate is even higher on non-stablecoin assets, which caused the price of these assets to rise as people buy them to supply and then borrow against them, he said.

These yields are predicated on the market cap of COMP, whose only 25% supply is circulating in the market currently with “no borrow market to short the spot COMP market and 2880 new COMP hitting the market every day for the next four years.”

While COMP prices may have risen exponentially to $240 at the time of writing, COMP September futures on FTX is much lower at around $185.

It’s Just temporary arbitrage, or there are unstated risksBesides the increase in DeFi tokens prices, last week, a new project, ‘BTC Yield Farming Pool’, was introduced by Ren, Synthetic, and Curve Finance together.

“The defi hunt for yield is nearing an interesting inflection point,” said Ari Paul of BlockTower adding that the incentives offered by DeFi projects are “too good to be true in that the high yields are ultimately coming from a future intrinsic value of tokens which can at most be worth the value that can be extracted as rent from future borrowers and lenders.”

I’m amazed no one has ever asked where the yield in DeFi comes from. In case you are interested, the yield in DeFi is ultimately subsidized by the poor retail traders who consistently lose money on centralized exchanges.

— Qiao Wang (@QWQiao) June 20, 2020

Qiao Wang also chimed in with “if you are making a fuck load of money right now farming DeFi yields, be thankful for the poor souls who just got liquidated by Arthur.”

According to Ari Paul, DeFi may be a “classic bubble fueled by liquidity mining,” which would unwind when maybe the system maxes out on leverage, chasers reverse course fast after stake mounts and yield average start falling, or maybe a bug or a game theory attack at a moment of vulnerability. He said,

“As the tokens start falling in value, that virtuous cycle of increasing locked up capital becomes a vicious cycle of falling token price -> falling yield -> less staked assets -> lower intrinsic token value -> lower token price.”

Amidst this growing frenzy, even Ethereum co-founder sounded caution,

“I think we emphasize flashy DeFi things that give you fancy high-interest rates way too much. Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.”

Instead of optimizing yield, it should be improving the core building blocks like oracles, DEXes, privacy, stablecoins, and synthetic tokens for fiat, he said.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|