2020-5-19 20:46 |

Coinspeaker

Andreessen Horowitz Says Fourth Bitcoin Bull Cycle Is to Come

American venture capital firm Andreessen Horowitz decided to monitor four key metrics for three cycles of Bitcoin and altcoins showing a consistent rise.

One of their realizations is that the fast growth of social media, developers, prices, and startups among cryptocurrencies could mean that a crypto cycle is supportive to traders in the future.

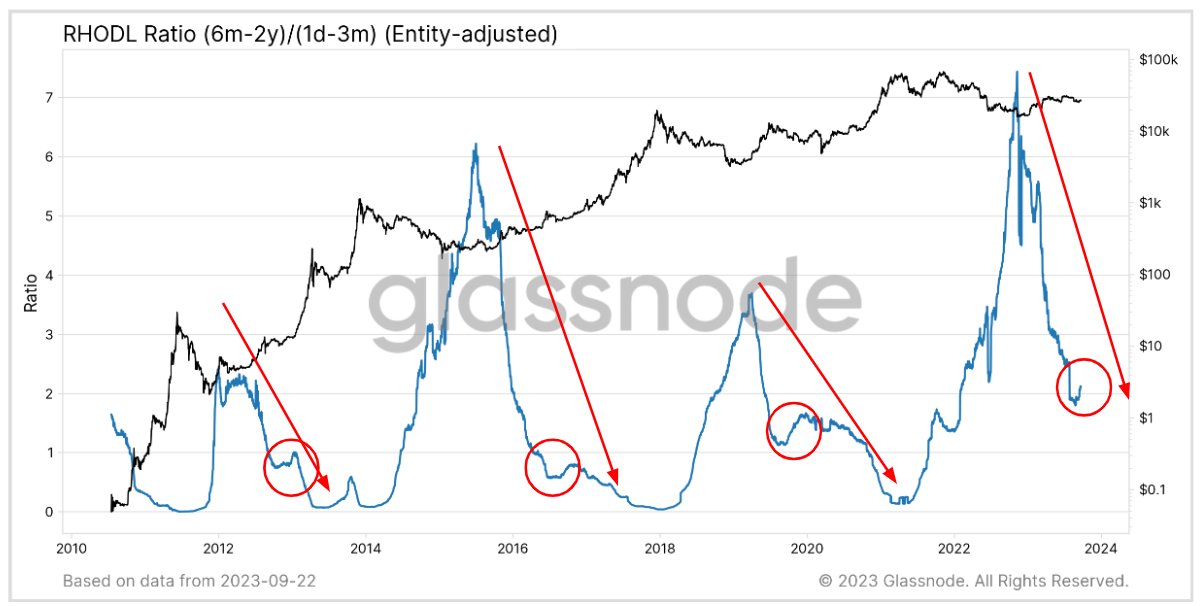

The company released a report on May 15 analyzing cryptocurrencies during three cycles, peaking in 2010, 2013, and 2017. As per its statement, the combined annual growth rates (CAGR) from 2010 to the present show ”choppy yet consistent growth in all of [these] key metrics.”

Each cycle has been defined by a growth of the price and is pursued by a revived interest in digital assets, new ideas for use cases and applications, and funding and startups as more people enter this sector.

Interestingly, the company says, in all cycles, it is discovered that interest failed to abate even after prices had increased.

Andreessen Horowitz Names Bitcoin Cycle One: 2009-2012During the first cycle from 2009 to 2012, the company saw that after Bitcoin began inclining in price, a number of new products showed up. As per the research, it was all along the first cycle when many crypto wallets, exchanges, and miners built their own companies, actualizing that cryptocurrency could make the basis of a business.

Cycle Two: 2012-2016The second cycle happened also after the price rocketed and what happened was the introduction of the smart contract platform, with Ethereum leading this wave.

According to Andreessen Horowitz, smart contract platforms then went on forming one of the most ingenious and possibly troublesome field of the so-called crypto economy. The cryptocurrency was no longer thought only as a digital form of money. It became money that can be programmed.

In spite of the peak in 2013, the second cycle was what boosted most of this extensive publicity that has developed in the third cycle, with the researchers arguing that:

“A key feature of crypto cycles is that each one plants seeds which later grow and drive the next cycle.”

Cycle Three: 2016-2019The third cycle, which came to its high in a crazy end to 2017, was the one during which crypto began to become appealing to some absolute mainstream people, as measured by social media activity.

The 2017 cycle produced dozens of interesting projects in a wide range of fields as are “payments, finance, games, infrastructure, and web apps,” according to the report.

Andreessen Horowitz said that the new ideas that were going on during the latest cycle have the chance to make a “fourth crypto cycle”, which, if continual, could see a likely growth in social media, developer, and startup activity as the price of Bitcoin (BTC) rises.

While this period will always be defined by the ICO boom, it also led to the development of major crypto players like Binance.

All crypto cycles have shown the same motif of prices driving interest, which boosted advancement and modernization.

This is however not the first time that Andreessen Horowitz released videos from its online “Crypto Startup School,” a seven-week education course for industry entrepreneurs that ran until mid-April. The company was also one of the first venture capital groups to invest in crypto companies, including Libra and Coinbase, among others.

Andreessen Horowitz Says Fourth Bitcoin Bull Cycle Is to Come

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|