2020-11-19 21:00 |

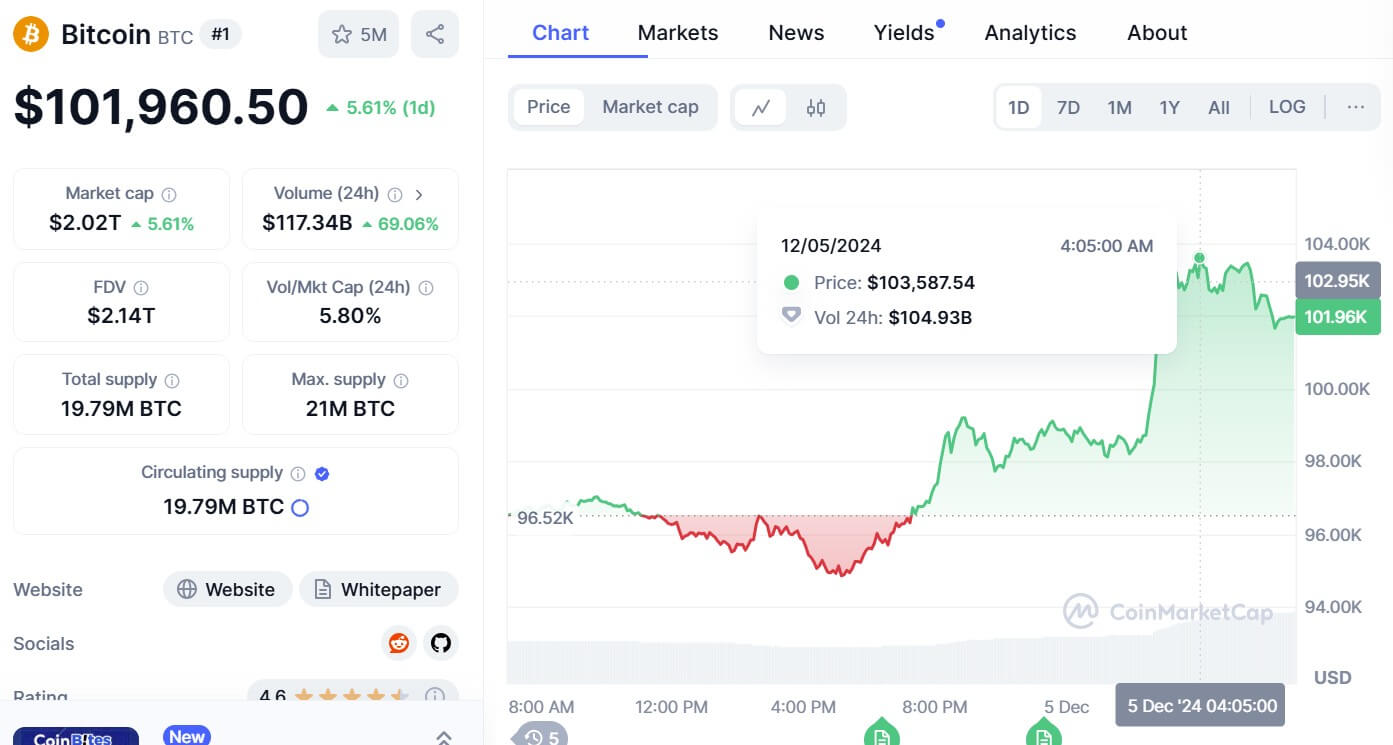

For the first time in weeks, Bitcoin saw a massive selloff yesterday evening that caused its price to reel to lows of $17,400 These lows came just over an hour after the cryptocurrency hit highs of $18,600, with this marking a fresh post-2017 high Where the entire market trends in the near-term will depend largely on how Bitcoin continues trading in the time following this selloff Bulls were able to push BTC back above $18,000 after these lows were set, but it has since drifted below this level One trader is now noting that he believes a move towards $19,000 is likely for the cryptocurrency, despite rising funding rates

Bitcoin and the entire crypto market saw some immense volatility yesterday that came about after the benchmark crypto saw a sudden surge up to highs of $18,600.

The selling pressure that existed at this price level was so intense that it sparked a $1,200 selloff that sent the crypto to lows of $17,400.

From here it saw a “V-shaped” recovery and rapidly pushed back towards $18,000. It has been consolidating just below this level ever since.

One trader does believe that a push even higher is imminent in the near-term. He targets $19,000, noting that this could come about despite a rising funding rate and premium.

Bitcoin Faces Immense Volatility Following Latest UpsurgeAt the time of writing, Bitcoin is trading up just under 1% at its current price of $17,800. This is around where it has been trading throughout the past day.

Overnight, bulls were able to catalyze a strong push higher that sent it to highs of $18,600. The selling pressure here was intense, suggesting that this rally over-extended itself.

It then faced a sharp move lower that likely came about due to an abundance of late long positions. This move sent it down to lows of $17,400.

Analyst: BTC Likely to Continue Towards $19,000 Despite SelloffOne trader explained that the underperformance of altcoins seen as a result of Bitcoin’s recent volatility suggests that attention is about to shift back onto BTC and allow it to outperform the rest of the market.

He is targeting a move up towards $19,000, although rising funding rates do provide a reason for concern.

“Alts dumping hard here vs BTC… Thinking $19k is very realistic even though funding & premium started spiking here.”

Image Courtesy of Mac. Source: BTCUSD on TradingView.Whether Bitcoin can gain a strong foothold above $18,000 should provide some serious insights into its short-term outlook.

Featured image from Unsplash. Charts from TradingView. origin »Bitcoin (BTC) на Currencies.ru

|

|