2024-6-5 10:16 |

Mt. Gox, a defunct crypto exchange, was spotted moving $9.62 billion worth of Bitcoin into a new wallet. This action has raised hopes among its creditors for potential repayments.

The transfer saw 141,686 Bitcoin transferred into the wallet “1Jbez” from various cold portfolios linked to the exchange. Moreover, it marks Mt. Gox’s first funds transfer in over five years, following its plans to reimburse creditors by the end of October 2024.

Anndy Lian, a blockchain expert and author of “NFT: From Zero to Hero,” noted that this significant transfer likely indicates Mt. Gox’s intention to repay its users. Lian emphasized that this movement is also part of the exchange’s strategy to reimburse creditors by the promised October 31, 2024 deadline.

Meanwhile, Mt. Gox rehabilitation trustee Nobuaki Kobayashi confirmed that the consolidation is part of the exchange’s repayment plans. In a May 28 announcement, Kobayashi stated that the Rehabilitation Trustee is preparing to repay the portion of cryptocurrency claims allocated for repayment. He also requested that creditors remain patient, hinting at potential delays beyond the initial deadline of September 2023.

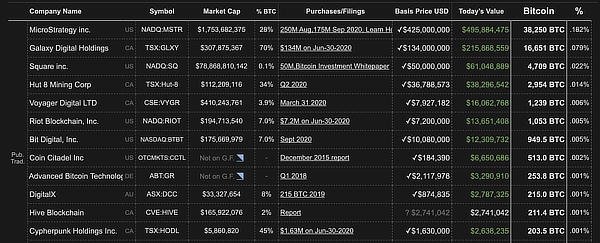

Over the past ten years, creditors have been hoping for reimbursement of Mt. Gox’s outstanding debt amounting to $9.4 billion worth of BTC. The exchange was once a major cryptocurrency player, facilitating more than 70% of all trades in the early days of Bitcoin. However, Mt. Gox collapsed in 2014 following a series of hacks.

Potential Market Impact of Mt. Gox Bitcoin Transfers Analyzed by CryptoQuantReacting to the development, on-chain analytics firm CryptoQuant analyzed its potential impact on the crypto market. CryptoQuant reported that the Mt. Gox Rehabilitation Trustee had moved 138,000 Bitcoin in seven transactions, ranging between 4,000 and 32,000.

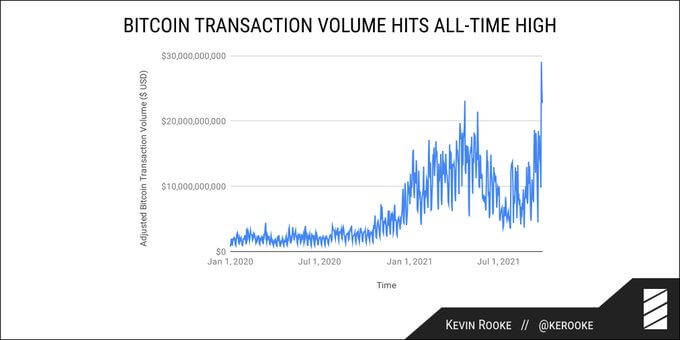

The internal transfers within Trustee-controlled addresses have not impacted the Bitcoin market. Nonetheless, the analytics firm noted that the eventual repayment to creditors, expected by October 31, 2024, could influence market dynamics.

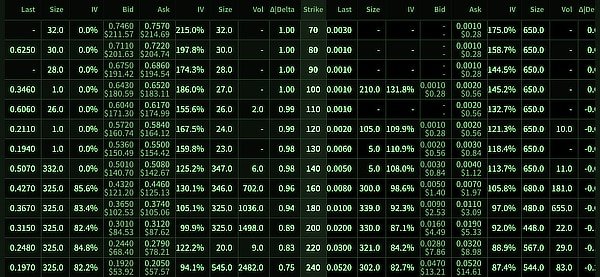

Furthermore, CryptoQuant highlighted that the market impact will depend on these repayments’ timing, size, and manner. If the Trustee starts repaying creditors, it could introduce a significant amount of Bitcoin into the market, affecting liquidity and price stability. The firm concluded that there is no immediate selling pressure from these movements since the transfers have yet to hit the open market.

Similar to Notcoin - Blum - Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|