2024-10-11 21:23 |

The crypto market adopted a bearish outlook following the recent economic figures.

Early today, the United States Bureau of Labor Statistics revealed that the yearly inflation jumped to 2.4% and up 0.2% in September, surpassing market expectations.

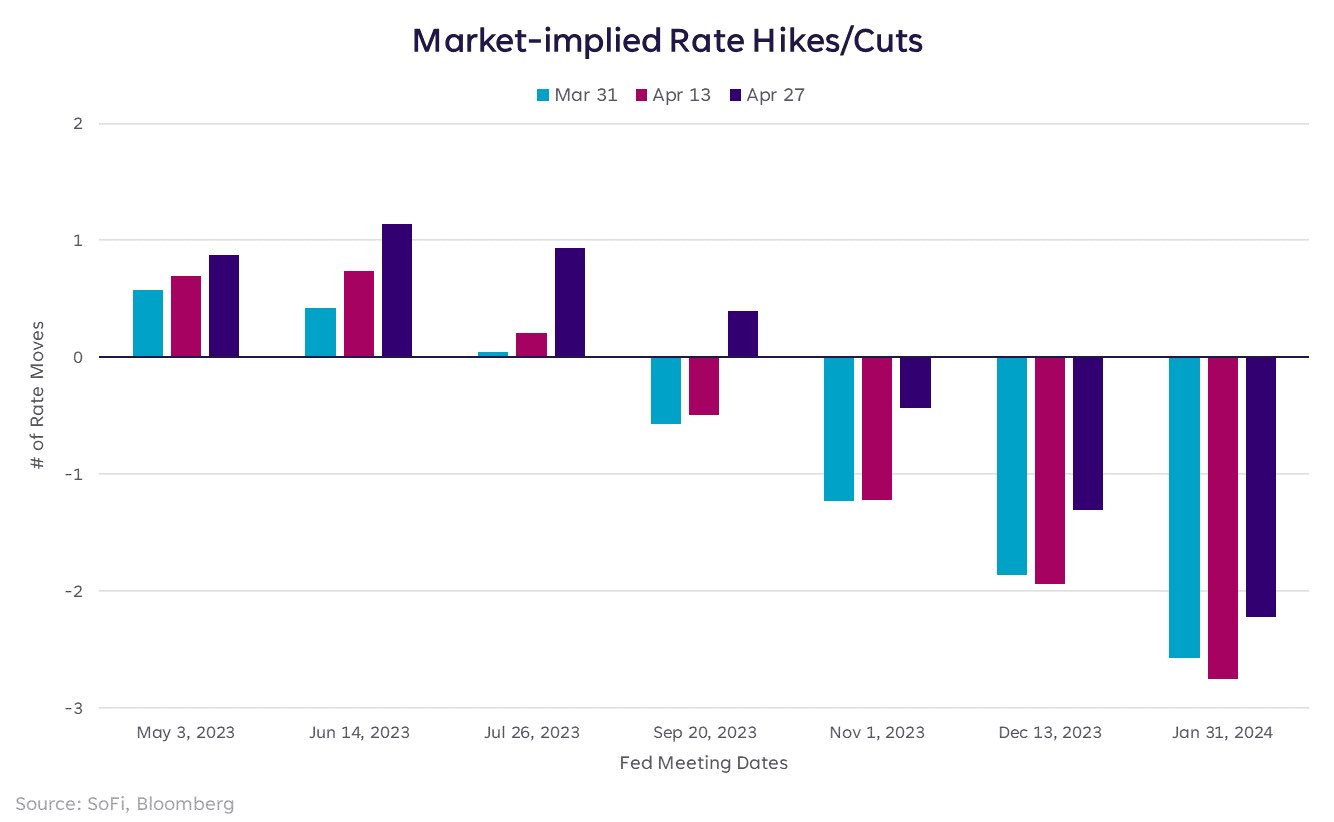

The cooled inflation, after the FOMC Minutes release, and the low-spirited US Job numbers attracted the attention of global investors, with crypto enthusiasts worrying about the probability of a hawkish Fed outlook in the upcoming meeting and Bitcoin’s looming plunge beneath $60,000.

These developments have catalyzed significant bearishness in the digital assets space.

The global cryptocurrency market capitalization plunged 2.70% in the past 24 hours to $2.11 trillion.

Bitcoin lost 2.69% on its daily chart to trade at $60,662 after hitting the $60,314 daily low.

The altcoin market mirrored the plunge, with Zilliqa, Yearn Finance, and Worldcoin recording notable price declines.

AI token Worldcoin lost 7.70%, Yearn Finance 2.50%, and Zilliqa 4% as sellers ruled the crypto world over the past day.

Furthermore, technical analysis suggests more dips, with Bitcoin eyeing the reliable support level at $58,000.

Source – Coinmarketcap US CPI, FOMC minutes sink cryptocurrenciesDigital assets plummeted on Wednesday as Bitcoin lost grounds above $62,500 to explore the $63,000 vicinity. The downside came after the Federal Reserve released September’s FOMC Minutes.

The latest US CPI data added to the downward pressure, cementing bets of a possible hawkish commentary by the Fed in their upcoming conference.

September’s United States Consumer Price Index stood at 0.2%.

The inflation dipped 2.4% year-over-year, exceeding market forecasts of 2.3%.

Nevertheless, the past month saw a modest increase since February 2021 (despite the hotter-than-expected numbers).

Meanwhile, the economic data triggered debates over the potential effect on the cryptocurrency space, with some forecasting Bitcoin’s plunge below $60,000.

Nonetheless, the latest inflation data has likely weighed on investor sentiments, dampening appetite for risk assets.

Crypto enthusiasts will now watch Bitcoin’s support at $60,000 – the area that prevented early October dips.

Maintaining this zone could support upswings toward the 200-day moving average at $63,500.

However, failure to cancel the current bearish wave could call for the next support barrier at $58,000.

Technical analysis by Ali Martinez backs the bearish outlook for Bitcoin. He revealed that the bellwether crypto remained trapped within a downward channel pattern.

Ali@ali_charts·Follow#Bitcoin remains stuck in a descending parallel channel. After the recent rejection at the upper boundary, we might see a drop to the middle boundary at $58,000 or even the lower boundary at $52,000. A bullish breakout won’t happen until $BTC clears $66,000!

2:49 AM · Oct 10, 2024325ReplyCopy linkRead 19 repliesMartinez highlighted the setup’s mid at $58,000 and the bottom border at $52,000 as crucial support floors for BTC.

Nevertheless, a shift in bias to bullish would see the digital coin breaking out of the declining channel to above $66,000.

The post Altcoins today: Zilliqa, YFI, and Worldcoin plunge as hopes for imminent Fed rate cuts fade appeared first on Invezz

origin »TodayCoin (TODAY) íà Currencies.ru

|

|