2020-3-7 17:11 |

Coinspeaker

Airline Stocks Take the Hardest Hit Due to Coronavirus

Amid the coronavirus spread, except cruise-liner stocks that were affected the most, the second one on the hit is the airline sector.

Shares of American Airlines Group Inc (NASDAQ: AAL) are continuously falling a few days in a row now. At the time of writing, the stock was falling 6.17% to $15.05 in premarket trading.

Southwest Airlines Co (NYSE: LUV) stock was plummeting 4.20% to $43.35 in the premarket session while Delta Air Lines Inc (NYSE: DAL) stock was down 4.02% to $43.20. United Airlines Holdings Inc (NASDAQ: UAL) stock was down 6.01% to $48.49.

The industry has obviously taken tremendous hit by the travel slowdown. Airplanes are ghostly empty and everybody is wondering is that a bottom edge. However, until the whole virus situation doesn’t come to its softening in the whole world – we cannot talk about bottoms.

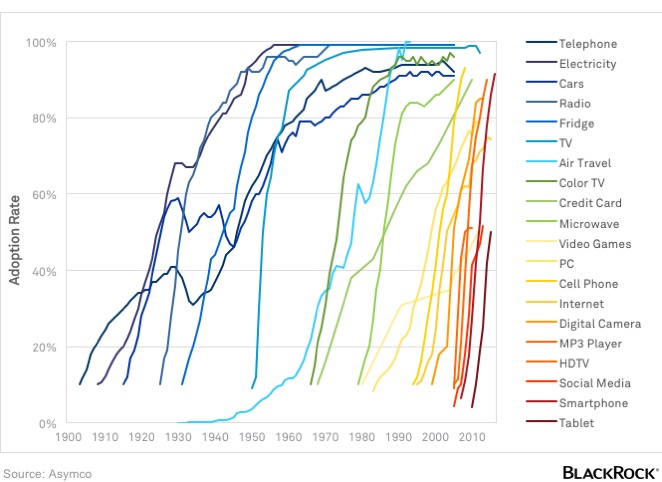

Waiting for the Spring Breaks: Will the Demand Rise?But let’s go from the beginning. It’s obvious that the demand for travel has fallen. Most companies canceled all traveling – either oversea either local. Almost there isn’t country in a world where there are no coronavirus cases reported. However, the time between December and March were the slowest time in normal days as well. Now the real question is: will the demand slow down during the spring break as well?

Unfortunately, since shares of Spirit Airlines Incorporated (NYSE: SAVE), Hawaiian Holdings Inc (NASDAQ: HA), and American Airlines Group Inc (NASDAQ: AAL) are down around 40% year to date, and many other airline stocks are not far behind – it is hard to expect that the situation can be so much better during the next few months.

United Airlines recently announced it is cutting its flight schedule for April, the company announced on Wednesday, as the coronavirus outbreak continues to impact demand. United’s domestic schedule will be reduced by 10%, while international flights will be cut back by 20%. Also, we should mention that in its new full-year 2020 earnings guidance, United Airlines Holdings, Inc. revealed it sees a decline in near-term demand in Asia amid the COVID-19 outbreak. The near-term demand in trans-Pacific routes, excluding China showed a drop of 75%, with the decrease in demand in China nearing 100%.

The International Air Transport Association yesterday said the coronavirus could cost airlines approximately $113 billion in lost 2020 revenue worldwide. That’s a lot more than the $29 billion estimate it had forecasted just weeks ago.

Flybe First One to Go BankruptInvestors were also worried when yesterday British regional carrier Flybe announced on it has entered administration. The collapse of the company comes due to the failure to raise enough funds combined with the coronavirus-related lack of bookings. All Flybe’s flights have been grounded and the company said it is unable to arrange alternative flights for its passengers.

Maybe a good thing in all of this that the U.S. industry came into this slowdown pretty much in good condition. The only thing that can happen now is that conditions deteriorate significantly. Then it wouldn’t be a good outcome. However, if the pace keeps on, the carriers should be able to go through without ceasing operations much or go to bankruptcy.

Good Time to Buy Airline StocksAlso, it could be a good time to buy if you were thinking of investing. Last week, Warren Buffett’s Berkshire Hathaway raised its stake in Delta last week during the sell-off.

Be it as it may, it’s not just U.S. airlines who got impacted by the COVID-19 spread. Since the virus came rapidly into Europe, its carriers are pretty much affected as well. Portuguese flag carrier TAP Air canceled around 1,000 departures in March and April following the coronavirus outbreak. The move will reduce the company’s capacity by 4% in March and by 6% in April while a majority of the flights that will be suspended were scheduled to fly from and to Italy.

Norwegian Air Shuttle ASA canceled 22 long-haul flights between Europe and the United States from March 28 to May 5. The low-cost airline already reduced its capacity by up to 15% this year, as a result of the lower demand for air travel.

Airline Stocks Take the Hardest Hit Due to Coronavirus

Similar to Notcoin - Blum - Airdrops In 2024

HitChain (HIT) на Currencies.ru

|

|