2021-3-24 22:35 |

Bitcoin options worth $5.5 billion in notional value are set to expire on Friday, threatening a drop to the maximum pain price of $44,000.

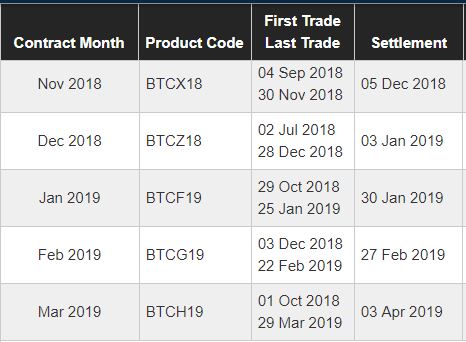

Bitcoin Options Set to ExpireQuarterly and monthly Bitcoin options, primarily traded on Derebit, will expire on Friday, Mar. 26. Those contracts have an Open Interest volume of $5.5 billion and strike prices between $4,000 and $120,000

Options contracts buyers purchase call or put options from sellers by paying a premium, thereby limiting their downside risk while allowing for maximum appreciation. Sellers are liable to buyers’ financial gains, while they also retain the entire premium in case of adverse price movements for buyers.

A higher volume of call orders above $48,000 and put orders below $44,000 place the maximum pain point at $44,000. This marks the strike price with the least rewards for all options buyers.

Max. pain for Bitcoin options contract expiring on Mar. 26. Source: Deribit InsightOptions buyers begin to book call yields by opening a short position of the same size, while sellers look to approach the maximum pain price, raising the possibility of price reaching that point at expiration.

Bitcoin’s consistent bullish trend has produced corrections four times out of the last nine options expirations, with consolidations in the other four and a bullish reaction only in July 2020.

However, quarterly options expirations in June, September, and December 2020 were relatively less volatile compared to other monthly options. In fact, the relevant values rose 77% and 85% after the last two quarterlies.

Bitcoin price chart with options expiration dates. Source: Trading ViewInvestors Roll Over PositionsAccording to a recent update by Deribit Insights, participants have rolled over their positions to April, meaning traders have sold and repurchased equivalent contracts for the future month. That has added to the selling pressure around Bitcoin’s price.

The put-to-call ratio of Bitcoin’s options has been rising and has increased from 0.84 to 0.94 since the end of February. That implies an increase in short options interest. Since options are usually used as a hedge against spot or futures purchase, this could signal an increase in spot and futures buying activity.

Another sharp increase in the ratio yesterday was caught by Deribit Insight’s Tony Stewart, who tweeted, “there has been a noticeable move higher in [the put to call] skew, which also occurred last time 50k came into view on the immediate downside.”

Nevertheless, times of low implied volatility attract options traders to buy both call and put options at low premiums.

Implied Volatility Is DownThe implied volatility (IV) of the options market has been in a downtrend, barely increasing after yesterday’s drop. The low IV also reduces the volatility expectations for the market.

Stewart noted that low IV against the sharp drop yesterday suggests that hedge funds have protection and that there is “no need to panic.” He also drew attention to the $1.38 billion in liquidations of perpetual contracts on derivatives exchanges, which implies institutional traders are hedged against a deeper correction far better than margin traders.

Bitcoin implied volatility of ATM options. Source: TwitterThus, as options traders move positions to future months and implied volatility stays low, reducing the overall impact of expiration, the market can expect consolidation at current levels.

Still, bulls face a lot of resistance around below $60,000 this week.

Disclosure: The author held Bitcoin at the time of press.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|