2023-8-5 14:06 |

So far in 2023, 13% of crypto hedge funds have been shuttered and the rate at which they are formed has slowed, data from 21e6 Capital shows.

The trend is at odds with the past performance of such funds, which have historically fared well when crypto assets increase in value. Compared to the beginning of the year, Bitcoin is up around 75% against the dollar.

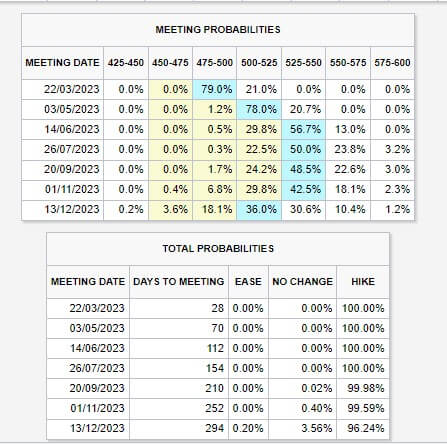

Crypto Hedge Funds Fail to Keep up With Bitcoin GainsAccording to 21e6 Capital’s database of crypto funds, hedge funds have struggled to keep pace with an increase in the price of Bitcoin. And across different fund strategies, USD returns in 2023 have lagged behind BTC gains.

In an analysis of the data, the Swiss firm found that directional funds have especially underperformed when benchmarked against Bitcoin.

Directional funds deploy strategies based on anticipated market movements. Compared to their non-directional peers, they rely more on futures markets and tend to make bets on short-term price fluctuations. When applied to crypto, directional strategies can fail when long-term trends break down.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Quantitative Strategies Prove Less EffectiveOf all the investment strategies hedge funds pursue, what’s known as a “quantitative directional” approach has proven to be the least effective in 2023. This strategy relies on statistical decision-making and tends to make use of trading algorithms.

Performance of Crypto Hedge Funds (Source: 21e6 Capital)As the 21e6 Capital report notes, such data-based approaches caused headaches for directional funds in a year defined by choppy markets. In other words, even though crypto prices have risen, they haven’t followed previously observed patterns.

This gives false signals to trading algorithms and reduces the predictive power of trend-following strategies.

Another challenge to algorithmic trading tactics is the recent proliferation of AI-generated content online. Quant funds are adjusting their data harvesting methods to safeguard the accuracy and effectiveness of their algorithms. This comes amid the increasing prevalence of AI-driven misinformation.

In fact, it isn’t just trading algorithms that are threatened by the increased prevalence of AI-generated content. Research has shown that across different families of machine learning models, when input data is corrupted by artificially-created material, the output is negatively affected.

Read More: 6 Best Copy Trading Platforms in 2023

Funds Still Suffering From FTX ContagionPersistent challenges stemming from the FTX bankruptcy last year have also affected the performance of crypto hedge funds. The fallout from the crisis has even forced the closure of some crypto funds.

For instance, Galois Capital shuttered in February with $40 million worth of assets trapped in the defunct FTX exchange.

Even funds that didn’t suffer any significant losses from the FTX bankruptcy have had to adapt to the post-FTX landscape of crypto trading.

FTX had been a prominent crypto derivatives exchange offering perpetual swaps, futures, and options. As there is currently no clear alternative to take its top position, funds heavily reliant on these derivatives have had to use exchanges with lower liquidity.

Banks Have Become Less Supportive of CryptoWhat’s more, according to 21e6 Capital, crypto funds have had a hard time accessing critical banking services all year.

On the one hand, following the FTX crisis, many banks adjusted their approach to the crypto sector as a whole. Under increased regulatory scrutiny, previously crypto-friendly banks have cut off ties with crypto hedge funds. This problem was only exacerbated by the collapse of Silicon Valley Bank.

As the report observes, “even exceptionally well-performing funds shut down due to lack of a new banking partner.”

Based on conversations with crypto funds, it concludes that:

“We sense that the market sentiment among [liquidity providers] is still lower than would be expected after a positive start to the year. Many funds certainly lagged the market and now have a harder time presenting a value proposition to their prospective investors.”

Read More: Top 11 Crypto Communities To Join in 2023

The post 13% of Crypto Hedge Funds Have Closed in 2023 Despite Bitcoin Climbing 75% appeared first on BeInCrypto.

origin »World Trade Funds (XWT) на Currencies.ru

|

|