2022-3-16 14:38 |

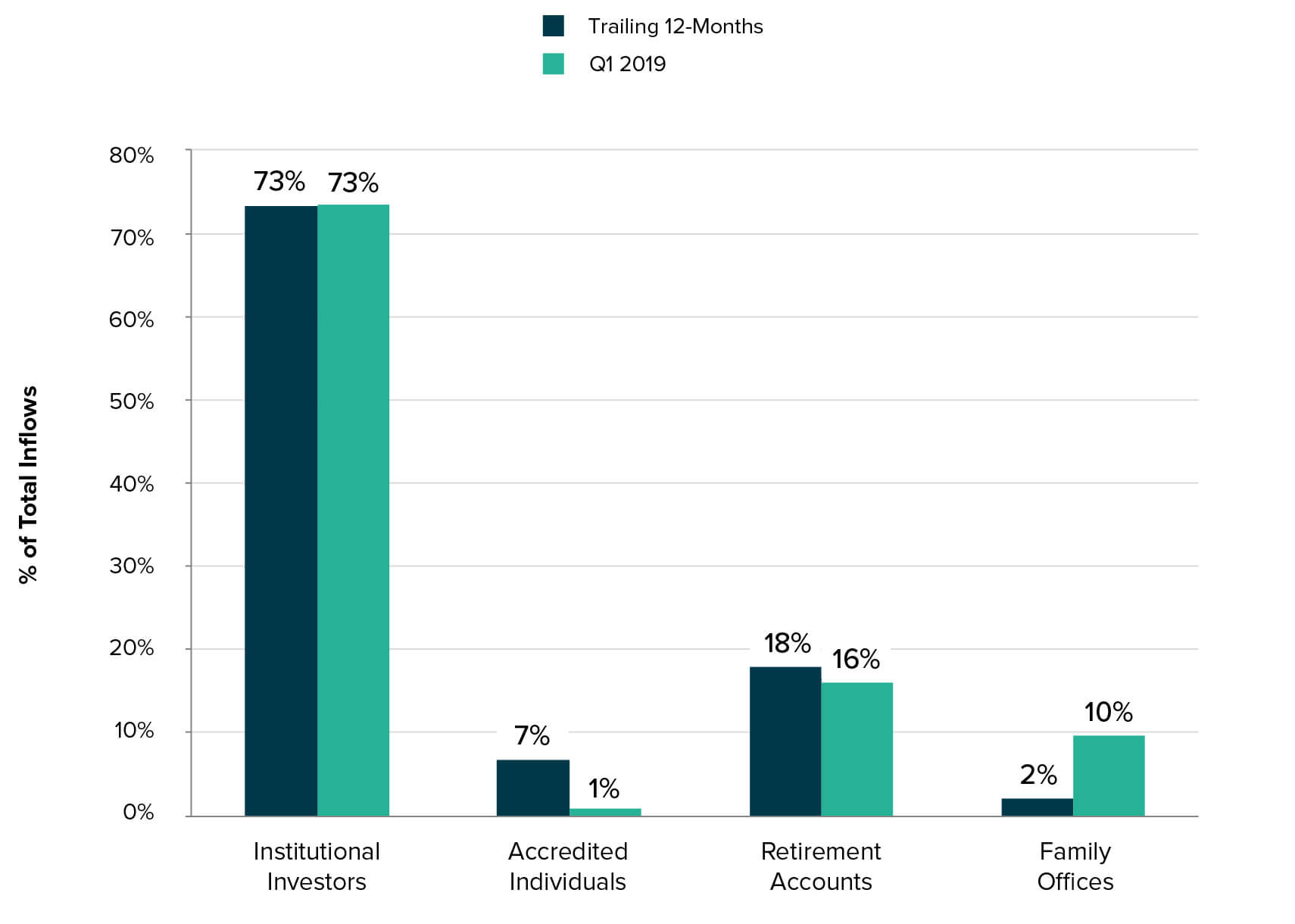

Large institutional investors are starting to become more comfortable with the crypto sector and pouring millions into the asset class. For years now, some of the world’s largest and widely recognized financial institutions have strengthened the infrastructure supporting cryptocurrencies.

The active involvement of institutions is evidenced by recent mammoth Coinbase outflows.

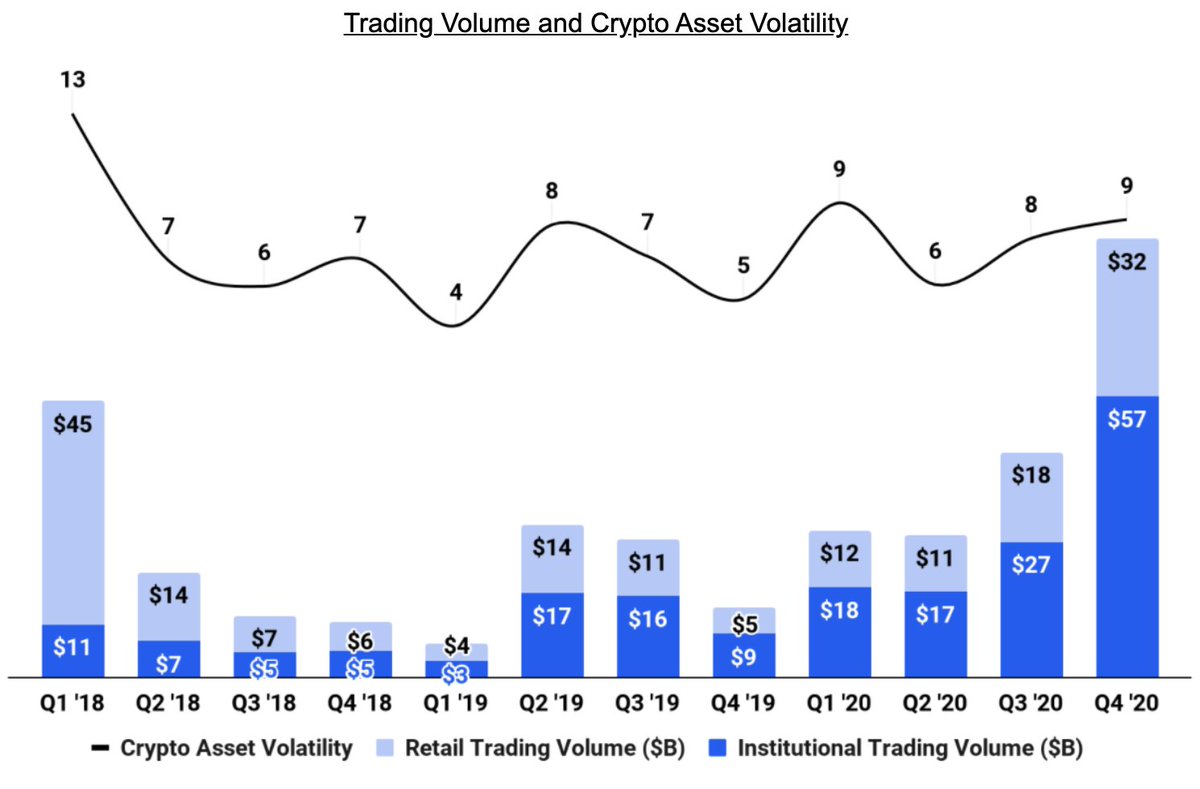

Bitcoin Continues To See Institutional DemandThe protracted whipsawing in the crypto market seems to have scared off retail investors. Institutional investors, on the other hand, appear to have a long-term focus; they aren’t thinking about short-term gains.

This rings true according to data provided by on-chain analytics platform Glassnode. Specifically, an eye-watering 31,130 bitcoin — worth approximately $1.2 billion — was moved away from the Coinbase exchange in the past week. This is the largest net outflow registered since 2017. It’s an indication that investors now view BTC as a new veritable investment asset.

The large rush has led to a considerable decrease in the total balance held on the San Francisco-based exchange to approximately 650,000 BTC. This is the same level seen during the peak of the 2017 bull run. In addition, Coinbase’s total bitcoin holdings have slumped by 36.6% from the record high set in April 2020.

The Glassnode report further notes that such massive outflows are a consistent trend with Coinbase balance. And being the largest publicly traded US-based exchange and the biggest crypto exchange by bitcoin reserves, this bolsters the thesis that bitcoin is being adopted as a micro asset by major institutional clients.

Launch Time?The Illiquid Supply Shock Ratio (ISSR) shows a meaningful rise over the past week. This means that the repositioned coins have actually been moved to wallets that have no history of spending.

The crypto market has been extremely volatile in recent months, with the price of the benchmark cryptocurrency going from a lifetime high of $69K in November to almost half of that in less than four months, triggering a rise in fear, uncertainty, and doubt.

BTCUSD Chart by TradingViewNonetheless, it’s clear the institutional acceptance of bitcoin as a key component of the global financial system is still soaring. As the adoption of crypto gathers pace and institutional players continue to actively participate in the market, the sector will keep growing and maturing.

And any serious spike in institutional adoption of digital assets creates more price support for cryptocurrencies. BTC sits at a heady price of $40,532.60 at press time, up 4.47% in the last 24 hours.

Similar to Notcoin - Blum - Airdrops In 2024

Fanaticos Active (FCA) на Currencies.ru

|

|