2019-1-30 05:18 |

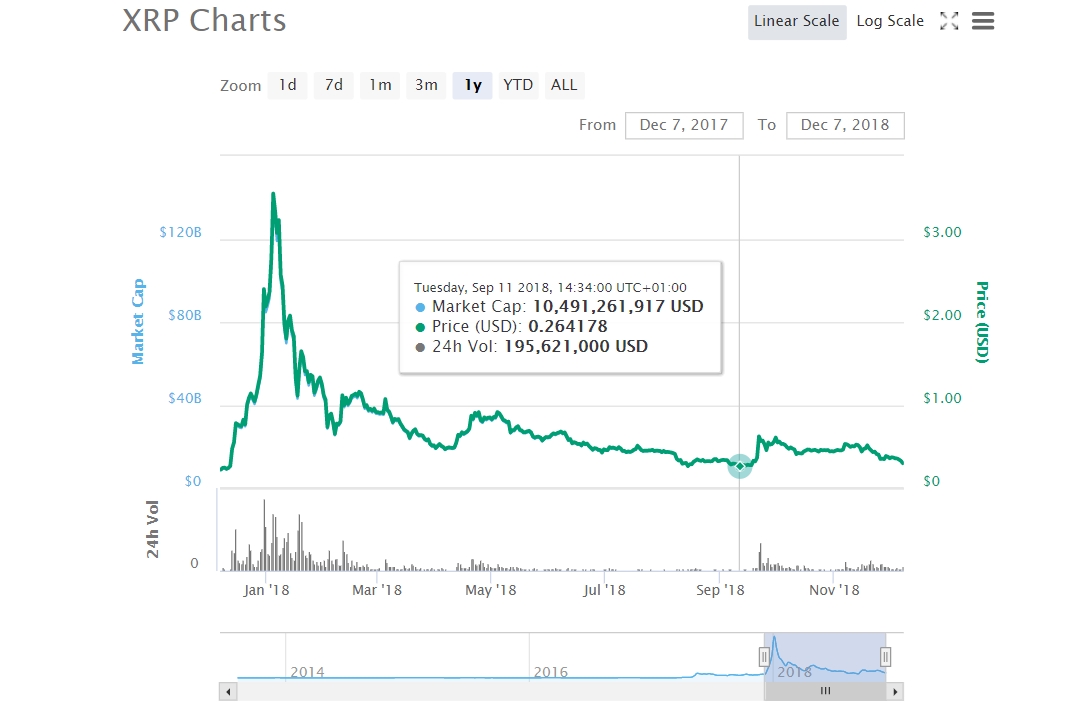

Ripple broke below its short-term consolidation pattern to signal that a continuation of the longer-term slide is due. Price is trading inside a descending channel visible on the 4-hour chart and has just tumbled below the mid-channel area of interest.

The 100 SMA is below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In other words, the selloff is more likely to gain traction than to reverse. The 100 SMA also held as dynamic resistance on the latest test and the 200 SMA could serve an additional upside barrier as well.

Price could be on track towards slumping to the very bottom of the channel at 0.2000. However, stochastic is pulling out of the oversold region to signal that buyers are about to return. In that case, a pullback to the nearby resistance levels could be seen. RSI is also turning higher after indicating exhaustion among sellers.

Cryptocurrencies have mostly been in selloff mode so far this week, and this is being blamed on the rise in stablecoin Tether that weighed on the negatively correlated bitcoin. From there, it spread to most of the altcoins, although some like Tron have been able to benefit from its own developments.

It’s not surprising that naysayers are piling on negative commentary with this massive selloff, further exacerbating the bearish pressure on Ripple and its peers. So far there have been no major positive updates to stem these losses or sustain any bounces.

The GTI VERA Convergence Divergence Technical Indicator shows bitcoin has now entered a new selling trend once more, and this was seen as a reliable predictor of the November selloff that happened across the board and wiped out massive amounts in the cryptocurrency market.

The post Ripple (XRP) Price Analysis: Still Far from Bottoming Out? appeared first on Ethereum World News.

Similar to Notcoin - Blum - Airdrops In 2024

Ripple (XRP) на Currencies.ru

|

|