2018-12-20 09:35 |

It’s been a little over a month since the Bitcoin Cash (BCH) network fork which resulted in a blockchain split. Besides the severed chain, the hash war was quite damaging to say the least, leaving BCH supporters to steadily pick up the pieces in order to bring the world a pure peer-to-peer version of electronic cash.

Also read: How to Spend and Give Bitcoin Cash Over the Holidays

One Month Later35 days later after the fork, Bitcoin Cash supporters are working towards moving past the hash war that took place a little after the scheduled BCH upgrade on Nov. 15. Now both networks are operating and the Bitcoin Satoshi’s Vision (BSV) coin has its own price ticker and market capitalization listed on data sites like Coinmarketcap and Satoshi Pulse. A portion of crypto-trading platforms have now listed BSV as a separate currency and the entire ecosystem of exchanges, payment processors and a great majority of wallets have awarded the ABC side of the chain the BCH ticker. At the time of writing, the global average price for BCH is $144 after markets jumped 47 percent on Dec. 19. BSV spiked 18 percent this Tuesday and each coin is currently trading for $92 per token.

BCH trade volume has spiked considerably by over $300 million in the last two days and gained 47% today.Since the fork, the BCH network hashrate has dropped considerably, even more so than the 50 percent loss BTC suffered this past month. Average hashrates for a great number of SHA-256 algorithm coins have endured deep drops in processing power according to global statistics. The Bitcoin Cash hashrate used to command a rough average of 5 exahash per second (EH/s), but now only captures 1 EH/s to 850 petahash per second (PH/s) on a daily basis throughout this month.

The Bitcoin Cash network has lost a considerable amount of hashrate as it’s been averaging roughly 1 exahash per second over the last two weeks. With the price increase over the last two days, the hashrate will likely follow.On the bright side, the BCH network has been 5-8 percent more profitable to mine than BTC over the last two days. Further, BCH has amassed a large swathe of different mining pools that are processing BCH blocks on a regular basis. This includes Viabtc, Btc.com, Antpool, Multipool, Bitcoin.com, Btc.top, Waterhole, Copernicus, P2pool, Ckpool, and some other unknown mining entities as well.

All the mining pools processing Bitcoin Cash blocks on Dec. 19, 2018. BCH Transactions and Volume Flattened After the Fork But Have Started Climbing AgainAnother BCH metric that has halved since the fork on Nov. 15 is the cryptocurrency’s daily transaction rate over the last month. Before, bitcoin cash transactions per day were about 20,000-25,000, whereas today that number stands at roughly 9,750 over the course of the last 24 hours. Over the last three weeks, the BCH daily transaction rate has been averaging 10k per day, with a few instances of 15k-22k spikes here and there. There has been a steady increase in daily transactions week after week, and with 99 percent of BCH infrastructure back in order, this should continue.

Daily transactions (tx) have dropped by 50% since the fork but have been slowly ascending back to 20-25,000 tx per day. Today the network has processed 9,759 confirmed transactions so far.A good example of this behavior is the increase in BCH price and trade volume on exchanges over the last few weeks. Pre-fork BCH trade volumes captured anywhere between $400-900 million worth of global trades every day. After the fork, this statistic dropped to around $50-100 million daily on global exchanges. This was because some cryptocurrency trading platforms with a ton of bitcoin cash liquidity had paused BCH transactions and some exchanges halted trading. Week after week, however, global BCH trade volume has been steadily increasing on exchanges like Upbit, Binance, Huobi, Lbank, and Coinbase Pro. With the 40 percent increase over the last 24 hours, BCH trade volume has jumped to over $400 million in global trades on Dec. 19. At the time of publication, this makes BCH the seventh most traded digital asset out of the entire crypto economy.

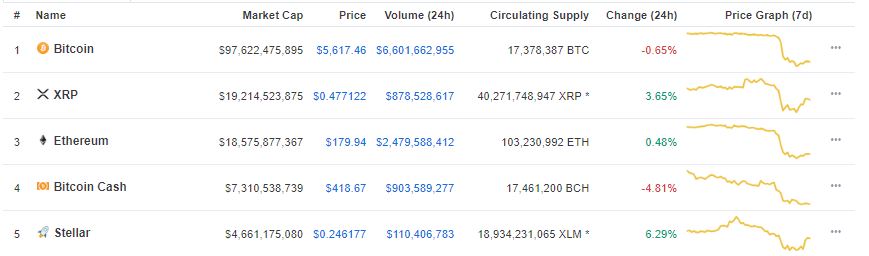

Bitcoin cash markets have regained the 4th largest market cap position today on Dec. 19 after climbing more than 40% during the course of the early afternoon trading sessions. Bitcoin Cash Moves Back to the Fourth Largest Cryptocurrency CapitalizationThe Bitcoin Cash community had also suffered from daily battles on Reddit’s r/btc forum and social media platforms like Twitter. A good portion of the trolling and infighting seems to have quietened down, and most BCH supporters are just trying to move forward. There’s been plenty of developments since the fork, with projects like Electron Cash, Honest Cash, Cash Shuffle, and Openswap adding more utility to the BCH network. Furthermore, BCH enthusiasts look forward to the upcoming BCH upgrades that are under discussion and they can track the code’s development too. For now, BCH supporters are extremely pleased that the fork is behind them and are thrilled to reclaim fourth position among all cryptocurrency market capitalizations.

What do you think about the last few weeks for Bitcoin Cash after the fork and subsequent blockchain split? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, Pixabay, Fork.lol, Satoshi Pulse, Bitinfocharts.com, and Coin Dance.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Hash Wars: BCH Proponents Face a New Dawn in the Battle’s Aftermath appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin Cash (BCH) на Currencies.ru

|

|