2021-7-21 21:40 |

The Grayscale Bitcoin Trust (GBTC) is a publicly-traded trust that invests solely in bitcoin.

Grayscale, GBTC’s holding company, is the largest digital asset manager on the market, and the GBTC is one of its biggest products.

BGTC is particularly appealing for Investors interested in crypto but not willing to hold coins themselves. In practice, the trust enables accredited investors to invest in the bitcoin market without directly holding coins.

The prices of GBTC shares roughly track bitcoin prices. These prices, however, tend to be higher or lower than current BTC prices with some regularity. As a result, investing in GBTC could be more expensive at times or more affordable at others than buying your own bitcoins.

Here’s a deeper look into the Grayscale Bitcoin Trust, how it works, and how it impacts the overall cryptocurrency landscape.

What Is the GBTC Bitcoin Investment Trust?The GBTC bitcoin investment trust is a bitcoin investment product that’s open to accredited investors to buy and sell in their brokerage accounts. The trust also sells over-the-counter; it can be traded and sold much like other U.S. securities.

Grayscale initially launched the Bitcoin Investment Trust (BIT) in 2013, as a private placement for accredited investors, exempt from SEC registration.

However, after gaining clearance from FINRA in 2015, BIT became the first publicly traded digital currency fund, along with two other products from Grayscale, the Ethereum Trust and Ethereum Classic Trust, which are similar products that invest in Ethereum.

On January 21, 2020, the GBTC also became the first digital currency investment vehicle to gain the status of a reporting company from the SEC. This change provided an early liquidity opportunity for investors, reducing the mandatory holding period of shares purchased through private placement from 12 to 6 months.

The Bitcoin investment trust has an incredible amount of sway on the global supply of crypto.

As of July 2021, the GBTC holds around 650,000 Bitcoin; this is around 3.1% of the globe’s total supply of 21 million, which is worth about $22 billion USD.

What Does GBTC Stock Offer Investors?The Grayscale Bitcoin Trust allows investors to invest in the Bitcoin market in the same way they can invest in traditional financial instruments.

Along with the ARK Next Generation Internet ETF, which holds the GBTC in its portfolio, and a number of other cryptocurrency vehicles from Grayscale, the GBTC is one of the few products that provides a link between traditional investors and the cryptocurrency market.

Shares of the Grayscale Bitcoin Trust are over-the-counter products and are traded publicly on the OTCQX, one of the three marketplaces for over-the-counter trading of stocks, rather than major marketplaces like the New York Stock Exchange (NYSE) or Nasdaq.

Only two of Grayscale’s other products, the Ethereum Classic Trust (symbol ETCG) and the Litecoin Trust (symbol LTCN) are traded publicly on the same marketplace.

Grayscale hopes to eventually convert the GBTC into an exchange-traded fund (or ETF), meaning investors would trade shares of the trust via an exchange, rather than the OTCQX marketplace.

Investors who hold shares in the Trust will generally see gains similar to investors who hold coins directly, but without the need to convert coins to fiat when they want to cash out.

The Trust has generated considerable returns for investors since its inception — including a tenfold increase in assets under management (AUM) in 2020.

Bridging Traditional Financial Services and the Crypto MarketThe GBTC ticker has seen major buy-in from large financial institutions. Morgan Stanley bought over 28,000 shares of the trust in June 2020. Morgan Stanley will allow individual investors to access these funds if they have at least $2 million in Morgan Stanley-held assets. For investment firms, $5 million will be necessary.

The move is part of the growing institutional interest in crypto technology like the blockchain, as well as Morgan Stanley’s broader effort to offer investors access to Bitcoin funds. In March 2021, the company announced internally that it would offer three cryptocurrency funds, provided by Galaxy Digital, FS Investments, and NYDIG.

Like the GBTC offer, these funds are only open to individual investors with at least $2 million, or firms with $5 million.

Despite institutional buy-in, the GBTC is new and could face serious pressure as investors determine the real value of GBTC shares. As the Trust gains notoriety, shifts in overall investor sentiment could affect it more significantly.

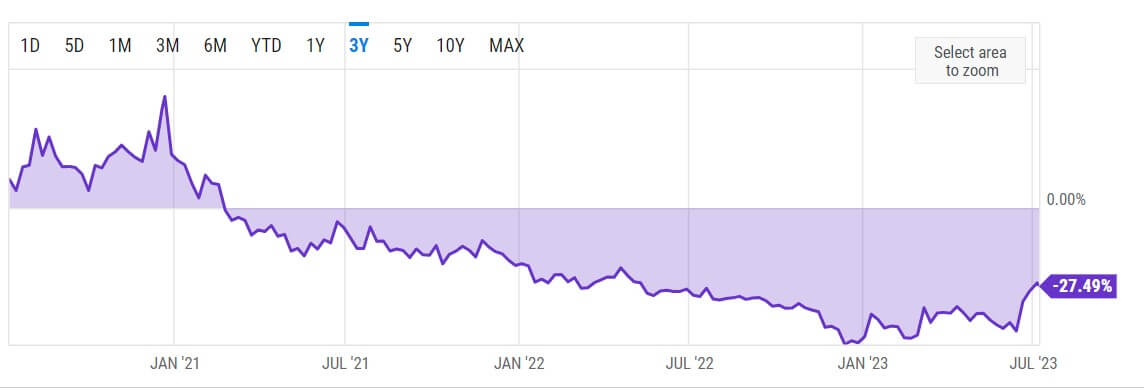

The GBTC saw major investments in December 2020 and January 2021, with inflows to GBTC reaching a record $2.8 billion in Q4 2020. As such, the mandatory six-month holding period for these investments expired in June and July 2021, allowing owners of GBTC shares to sell. In total, shares representing around 40,000 Bitcoin will become available for trading.

The biggest single-day unlock occurred on July 17, and a total of 16,240 GBTC shares became available.

Analysts from Morgan Stanley believe that, due to this “unlocking” of purchased shares, some of these investors will sell.

If enough investors sell, the movement of shares could potentially exert pressure on other holders, encouraging them to sell. This could drive down the value of the GBTC and Bitcoin itself, simply due to how large the GBTC is.

The Bitcoin investment trust price traded at a peak of $56.70 in February 2021, and has traded between $20 and $28 since.

Why Should Investors Care About Grayscale Bitcoin Trust (GBTC)As an over-the-counter investment vehicle, investing in GBTC shares is much like investing in any other U.S security.

Much like more standard stocks, the Grayscale Bitcoin Trust is eligible for some tax-advantaged accounts. If you hold an IRA or Roth IRA, for example, you may be able to invest in GBTC shares with these accounts.

For accredited investors who want to buy shares in the fund as a private placement, the trust requires a $50,000 minimum investment and charges an annual 2% fee that accrues daily. Because shares of the Trust are also available OTC, they can be bought and sold in the same way as any other U.S. security. Investors can buy as little as one share in the GBTC.

Final Thoughts: The Future of the GBTC and Similar Crypto ProductsInvestors wanting to invest in crypto without directly holding coins have a number of options — with the GBTC being one of the largest and most prominent.

Along with the other Grayscale digital asset products, the Trust also provides one of the most straightforward ways for mainstream institutions to invest in the crypto market.

While there is a growing number of digital asset products available to investors, the size and value of the GBTC mean it will likely remain relevant well into the future.

The post Grayscale Bitcoin Trust (GBTC): Why GBTC Moves Markets appeared first on CoinCentral.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|