2022-6-3 02:00 |

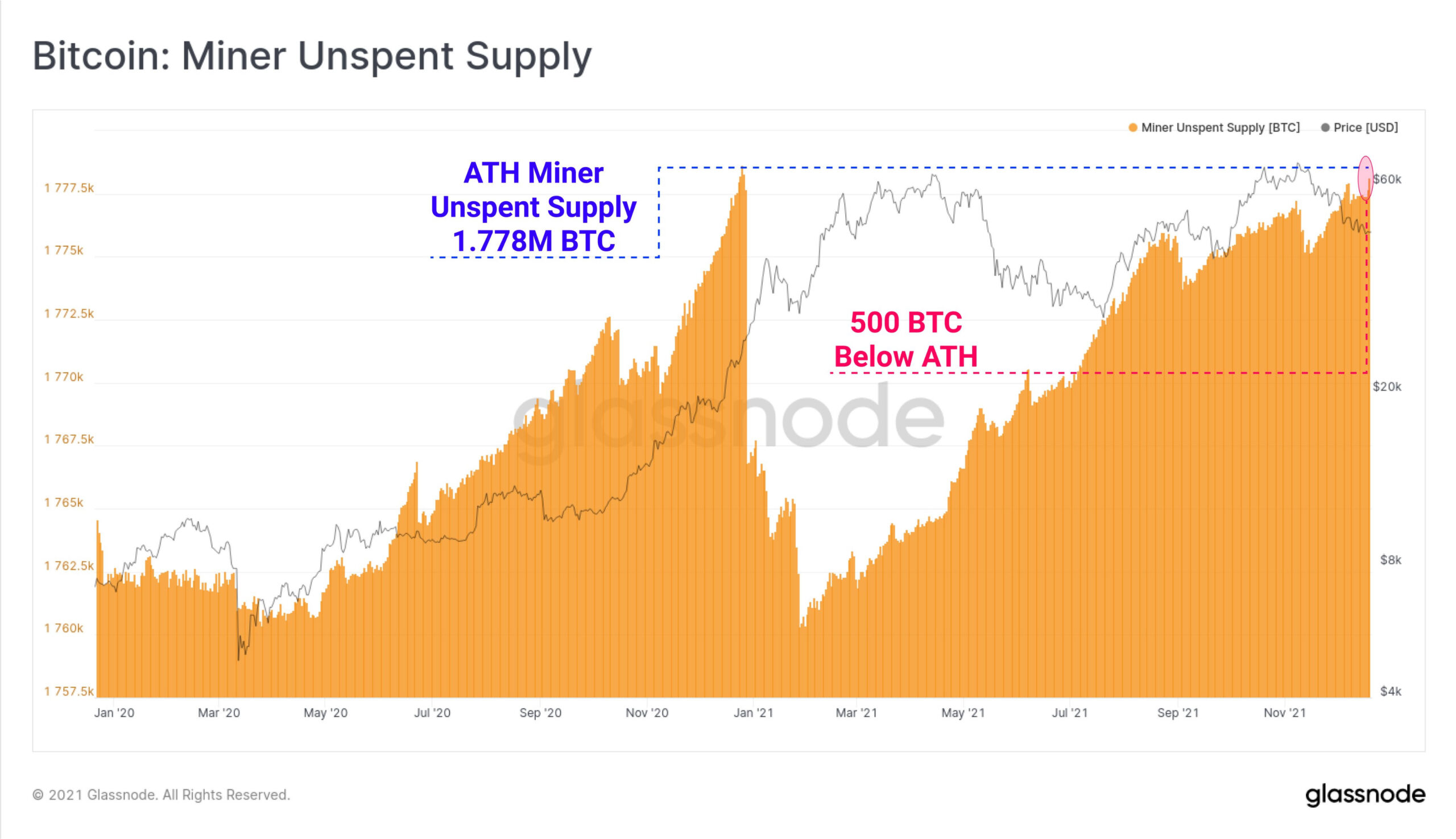

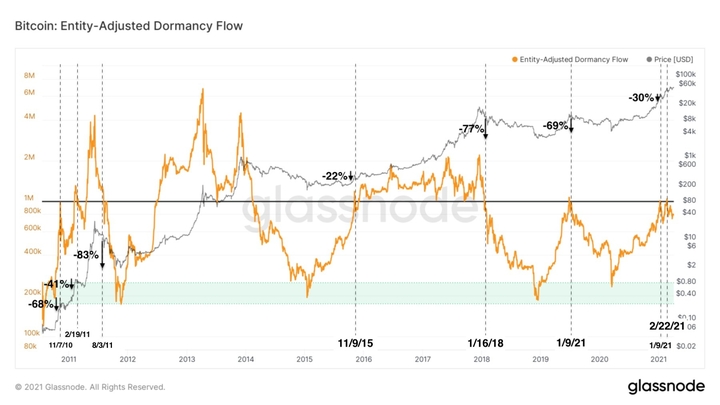

For the longest time, bitcoin miners have held on to the spoils of their activities. That is when the profitability of mining the cryptocurrency was still high. Due to a high cash flow, these miners could afford to hold on to a good portion of their rewards while being able to still carry out their operations. However, recent market trends have tanked the profitability of bitcoin mining, leading miners to start dipping into their BTC stash and selling to keep operations alive.

Bitcoin Miners Are SellingA good number of bitcoin miners had held on to the considerable bags mostly through the bear market. With the turn of the market and bitcoin now trading below $29,000, it has become harder for miners to hold on to these coins without compromising their ability to fund their operations. The result of this has been a number of prominent bitcoin mining companies coming out to say that they have sold or will be selling some of the BTC they hold.

Related Reading | Bitcoin Exchange Outflows Suggest That Investors Are Starting To Accumulate

Marathon Digital is no doubt one of the first names that pop up when the topic of bitcoin mining comes up. The company has been able to cement its position as a top contender in the mining world and has attracted a large number of investors but even big companies have not been able to escape the market onslaught.

Last month, the firm had announced during an earnings call that it may have to sell some of its bitcoin holdings. Marathon Digital holds more than 9,600 BTC, most of which it has held for almost two years. However, it seems the day of reckoning is fast approaching and even large companies will have to get rid of some of their BTC.

BTC continues to struggle as sell-offs intensify | Source: BTCUSD on TradingView.comCompanies that have already sold some of their BTC include Riot and Cathedra Bitcoin. Riot had reportedly sold about $10 million worth of Bitcoin back in April which came out to a total of 250 BTC. Most recently, Cathedra Bitcoin had announced that it sold 235 BTC at an average price of $29,152. It came out to a little over $8.7 million. The company explained in its report that this was to help it insulate “itself from additional declines in the price of bitcoin and maintains its liquidity position.”

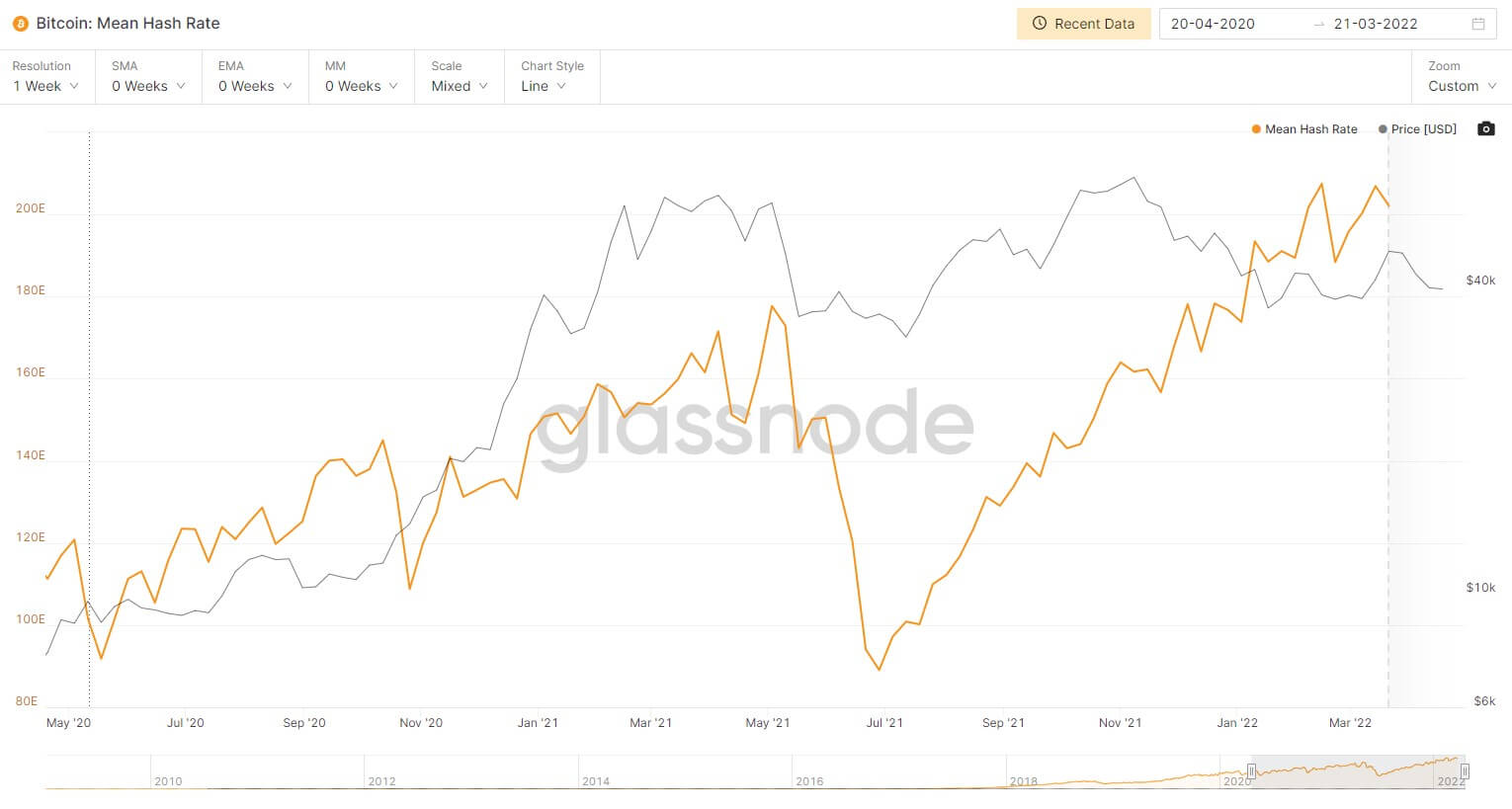

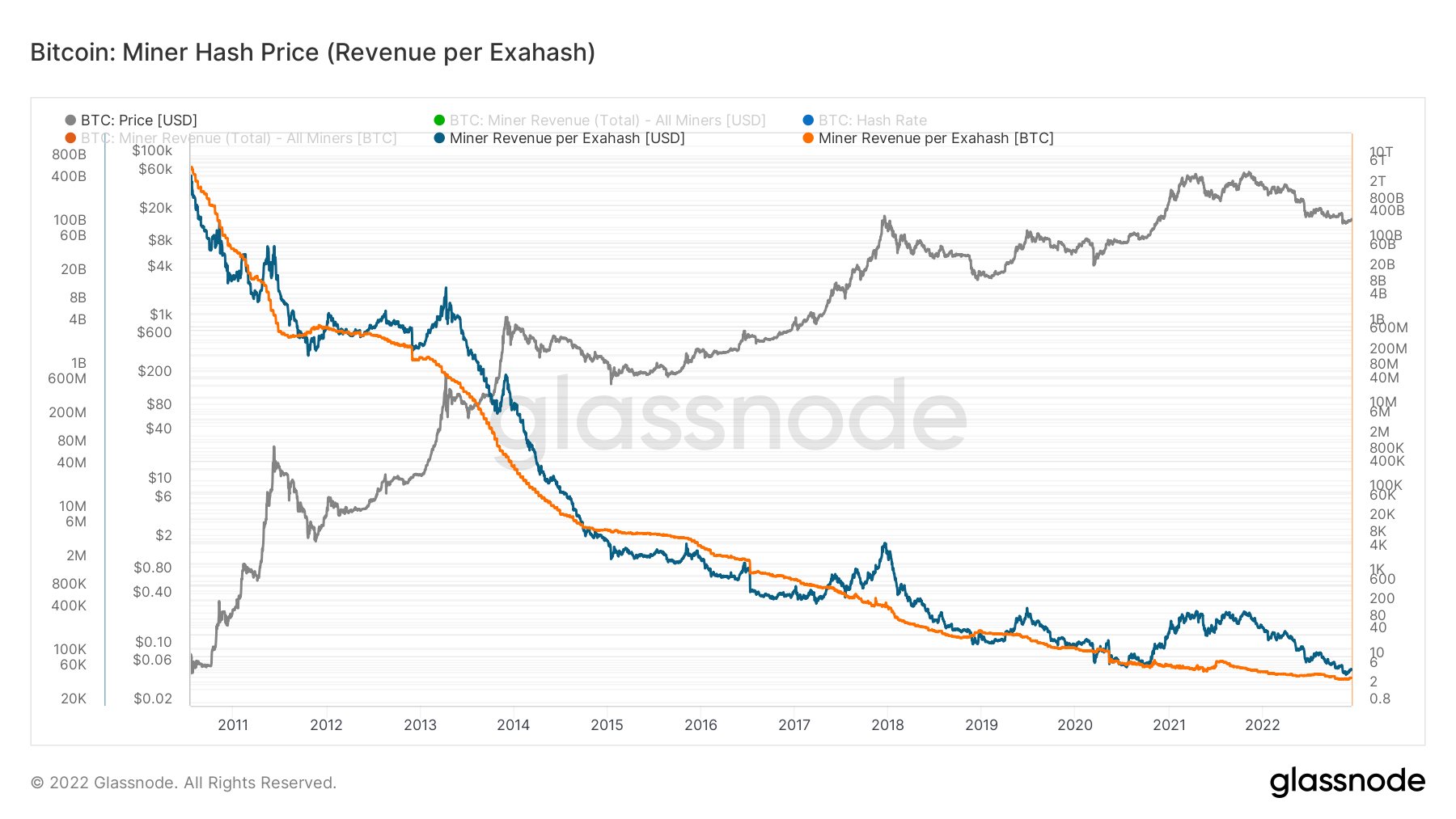

Mining No Longer Profitable?Bitcoin mining remains profitable but with the price more than 50% down from its all-time high, the profitability has declined by a significant margin. A report from Bitcoinist highlighted the profitability of BTC mining machines. The miners are now returning 50% less cash flow than they did when BTC was trading at $69,000.

Related Reading | Bitcoin Rests Tentatively Above $31,000, Bull Rally Or Trap?

Additionally, daily miner revenues are still on the low side. It had grown by 4.50% last week to land at its $26,706,581 value but these remain low. It is a result of the average transaction value and daily transactions being down over the past week.

Faith in bitcoin mining stocks is also on the decline. So now, miners are forced to sell some of their BTC holdings to be able to keep their operations going.

Featured image from Outlook India, chart from TradingView.comFollow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

Similar to Notcoin - Blum - Airdrops In 2024

Miners' Reward Token (MRT) на Currencies.ru

|

|