2020-7-9 21:46 |

The U.S Senate sanctions that were passed in response to the Hong Kong security law might affect crypto brokerage operations.

Dubbed the ‘Hong Kong Autonomy Act,' this senate bill aims to reprimand China for eroding the city's autonomy, which had long favored its position as a financial hub. According to the new security law, Hong Kong's freedom of expression has been infringed to the extent of not being allowed to criticize the Chinese Communist Party (CCP).

With the U.S acting as the leader of the free world, a counter move on this infringement was to be expected. Now that the Senate has already given the green light; the U.S government can now move to limit its foreign registered subsidiaries in Hong Kong from providing access to the dollar ecosystem. These limitations will be in situations where the other party is undermining Hong Kong's autonomy. However, the bill did not specify what criteria would be used to arrive at such decisions, leaving this to the U.S Treasury.

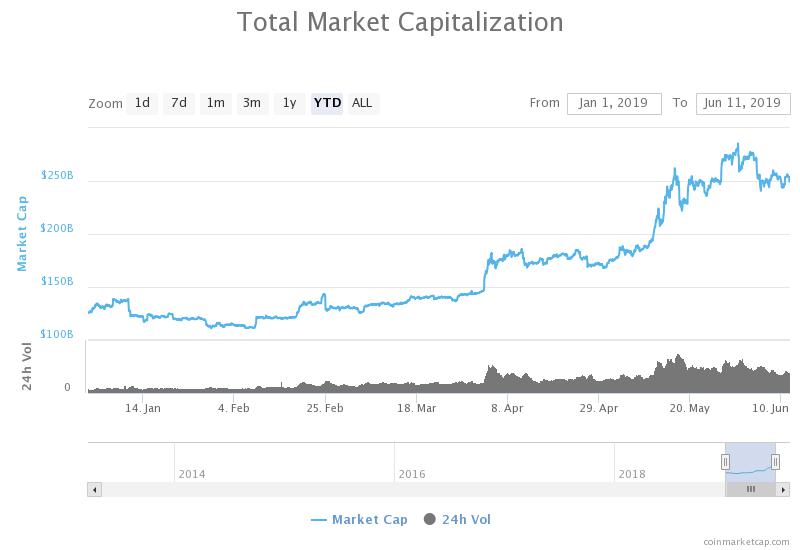

The Effect on Crypto BrokeragesThese moves by the U.S senate and CCP could have a significant toll on crypto brokerages operating in Hong Kong. The city has long been a link between mainland China crypto businesses and international markets, given its friendly nature towards digital assets. This link has since motivated mainland China-based crypto exchanges such as Huobi and OKCoin to set up in Hong Kong.

While their operations are majorly in Asia, access to the dollar ecosystem is fundamental for liquidity and other aspects. According to the president of Hong Kong's Bitcoin Association, Leo Weese, a move to curtail liquidity provision would be catastrophic for the Hong Kong-based exchanges:

“The most successful cryptocurrency companies here are dependent on their access to the U.S. dollar system … They move money around, they are big brokers, and if they somewhat lose that access, they are in trouble.”

Weese's sentiments were seconded by other stakeholders in this market, including Genesis Block's chief trader, Charles Yang, who noted that reliance on U.S banks for dollar settlements is inevitable. Consequently, the ongoing friction puts their business at more risk.

“If there is any further friction from the U.S. policy, it could be very damaging to our business.”

Hong Kong's Financial Dominance in LimboWhile the new security law doesn't intend to change Hong Kong's financial status, this could quickly change, according to Weese.

“I think for now there is no intention to mess with Hong Kong's financial system and scare companies away, but of course things could quickly change.”

As both the CCP and U.S continue to fine-tune their stance on this development, a move to Beijing as China's financial hub will mean more scrutiny by the government. This might, in turn, make wire transfers and other financial services expensive and slower compared to the autonomy that preceded business in Hong Kong.

origin »Bitcoin price in Telegram @btc_price_every_hour

Hong Kong Dollar (HKD) на Currencies.ru

|

|