2019-1-10 21:09 |

While a day is a short one in politics, that is an understatement for cryptocurrency enthusiasts, especially as they look at 2018 as if it weren't just a few weeks ago. It doesn't take too much recollection to remember the lofty days when cryptocurrency market capitalization stood at just over $300 million with all the potential of climbing higher.

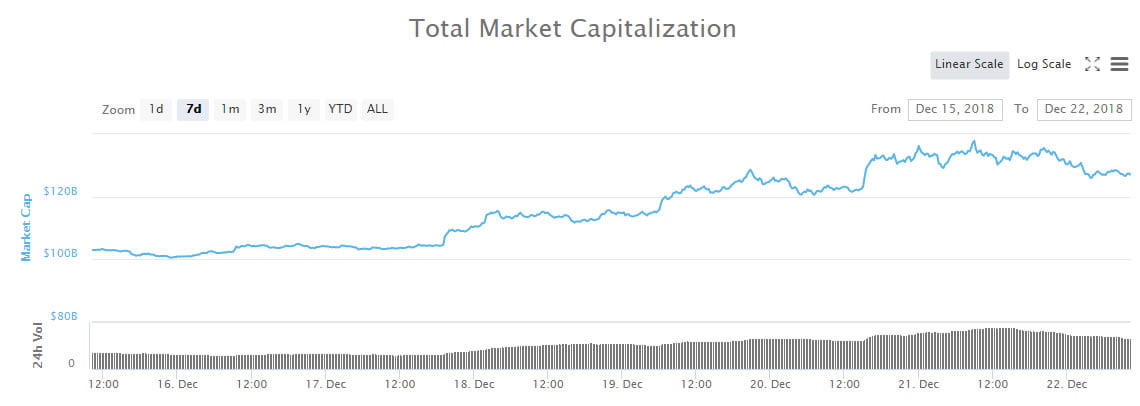

It was at this time that the market was still ebbing on the fumes of a bullish market, especially as Bakkt alluded to the creation of a crypto-based Wall Street, but then the cap was slashed in half by the tail-end of 2018.

Since this time, both the rhetoric of places like Wall Street and Goldman Sachs became murkier when approaching cryptocurrency. Meanwhile, Coinbase has never been clearer with its intentions, and while it had begun reaching deeper into blockchain innovation and development, it appears to be taking a firmer grip back into its roots.

Instead of pushing into an otherwise unclear and hazy east-coast Wall Street, Coinbase is sitting firm in San Francisco's Market Street, turning its eyes back onto blockchain projects like Polychain and Pantera over BlackRock and Goldman Sachs.

So How Did We Get Here?Along with this pivot away from Wall Street, this involved the decision to no longer pursue Jonathan Kellner, Coinbase is surprising the market at large. According to Adam White, who discussed this steady transition to capitalise on institutional investment during an interview in May 2018.

White spoke about how Coinbase intended to seize upon a “wave of institutional capital waiting on the sidelines.” White went further to stress, however that “before it moves into space, we have to have the fundamental components, the infrastructure, institutions are used to.”

While this was the initial strategy that White spearheaded, he began to face continued opposition from senior management, according to those that worked in close proximity during this time.

What caused this resistance to grow was the fact that it became increasingly obvious that it would be futile to communicate with Wall Street during a bearish downturn in the cryptocurrency market.

And that's not exactly surprising for companies that work in close proximity to Wall Street – they often require far more in the way of financial support than just a cryptocurrency fund; services like derivatives, hedge funds as well as margin are needed.

What About the Institutional Money?In Coinbase's mind, the institutional money is out there, and they don't doubt that. Edward Woodford, who works as the CEO of SeedCX, a cryptocurrency exchange, stated that institutional interest is not only out there, but it is growing a considerable rate.

While the push to Wall Street has been cooled somewhat over the last few months, it hasn't stopped it outright. For example, it has shown no intention of stopping its foray into the Chicago exchange to build out its Wall-Street quality matching system. Neither has it slowed its custody business either, it's just a re-shifting of its priorities.

While the decision not to pursue Kellner was met with some skepticism from investors, ones that see it as a big loss for Coinbase, losing it one of the intuitive minds of Wall Street. Meanwhile, others see it as just a re-orienting of priorities back to its natural proclivity, allowing it to strike out again from a position of strength.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|