2021-11-30 17:53 |

Changpeng Zhao (CZ), the CEO of Binance, took time for an interview on November 29 to share details on how the largest crypto exchange operates. During the interview, CZ noted that Binance is an ecosystem of projects. While most people only know Binance as a crypto exchange, he claims Binance has dipped its toes into multiple sectors.

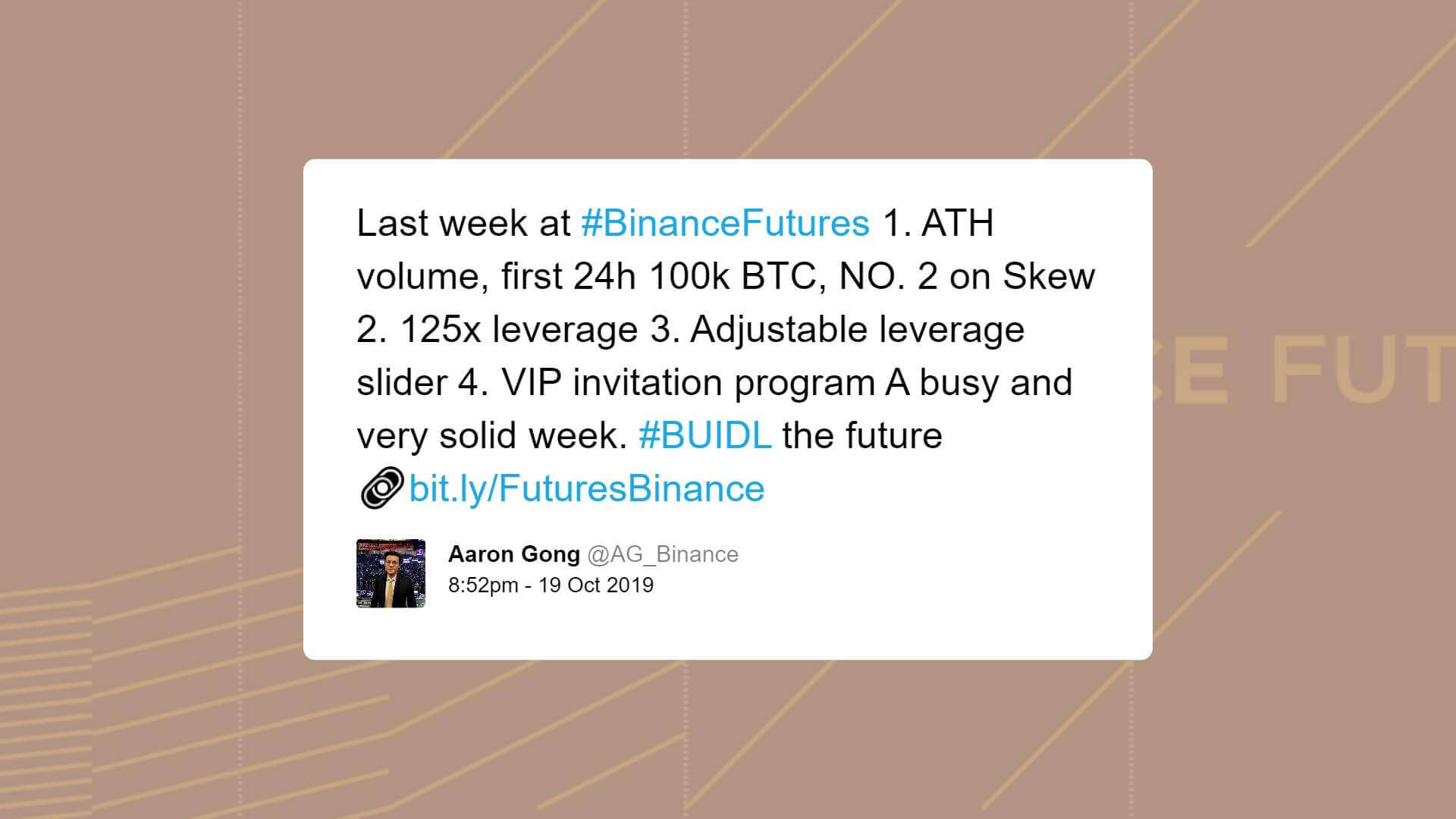

According to CZ, Binance is the largest crypto-to-crypto exchange by trading volume in spot and futures markets. He pointed out that Binance often handles 10x more volume than the runners-up. The platform is also the leading fiat-to-crypto exchange, supporting over 50 fiats across the globe.

He further touted Binance, saying,

In addition to those, we’re also one of the largest peer-to-peer marketplaces. Typically, in places where banks don’t want to work with crypto exchanges, people trade peer-to-peer, and crypto is escrowed to our platform. Local Bitcoins is typically viewed as a leader in that space. We are slightly bigger than them.

On top of this, Binance has one of the most downloaded wallets. Per CZ, people have been actively downloading Trust Wallet, which Binance acquired three years ago. The exchange also owns CoinMarketCap, one of the most visited crypto websites. Moreover, Binance features an NFT marketplace, which CZ believes is the second-largest after OpenSea.

Excelling in multiple fieldsCZ further disclosed that his company contributed to Binance Smart Chain (BSC), an open, scalable blockchain network that has caught on quickly. He cited an example of how BSC handled 14 million transactions on November 28 while Ethereum (ETH) only carried 1.2 million transactions.

BSC also beats Ethereum regarding the number of active addresses, according to CZ. He claims that the network has an 80% market share in the decentralized finance (DeFi) space. However, he admitted that the TVLs of other blockchain networks are higher.

Explaining why BSC has more users, he noted that BSC is cheaper and faster than blockchains like Ethereum. The Binance CEO said Ethereum forces users to place bids for their transactions to go through. This process results in high gas fees, with the average transaction cost landing between $10 ($7.49) and $30 (£22.48). On the other hand, BSC only charges cents to complete transactions.

Realising the weaknesses of Ethereum, BSC developers designed it to be EVM compatible. This feature helps projects on Ethereum migrate to BSC and enjoy scalable and cost-effective transactions.

A unique tokenCZ also spoke about Binance Coin (BNB/USD), saying it is unlike any other token in the space. He pointed out that the coin is native to Binance Chain and BSC, making it the only token native to two different blockchain networks. The Binance CEO added that the creation of two more blockchains with BNB as the native token is underway.

At the time of writing, BNB is changing hands $625.37 (£468.52) after gaining 1.76% in the day and 8.18% over the past seven days. The coin is the third-largest crypto by market capitalization, with a market cap of $104,312,029,815.00 (£78,149,008,056.95).

The post CZ shares what investors should know about Binance’s business model appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|