2021-2-8 15:34 |

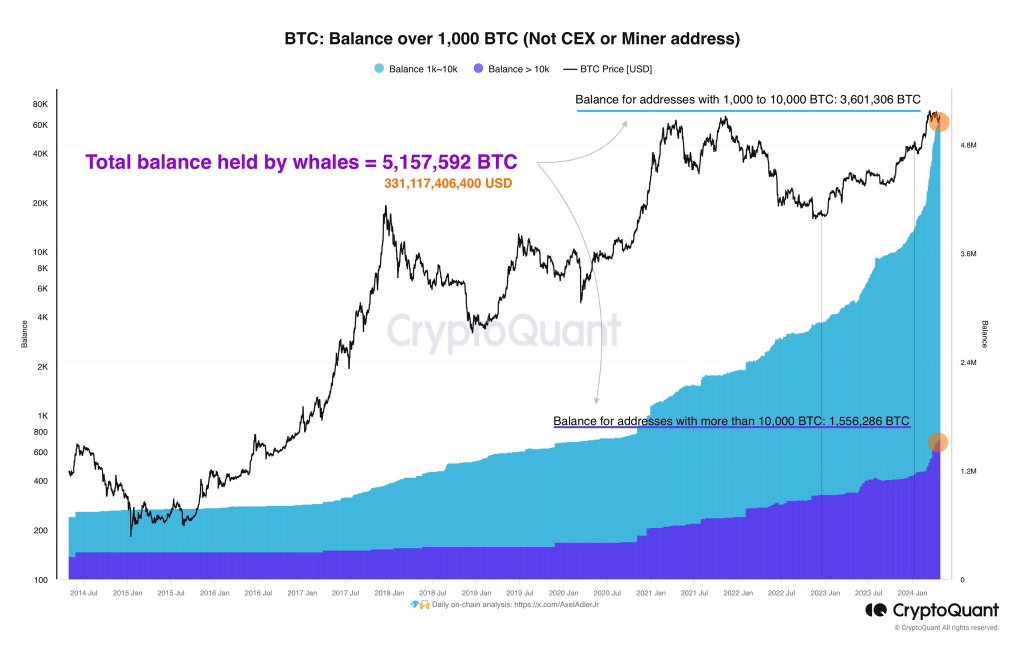

The fundamental factors supporting Bitcoin’s bullish prospects have continued to gain momentum over the weeks. On-chain data shows that the unprecedented records of whales buying up Bitcoin is causing a supply shock.

High-net worth individuals, also known as whales, are creating intense pressure on the demand for Bitcoin.

Bloqport has revealed that the number of Bitcoin holders with more than 1,000 BTC just increased. Since the beginning of the year, more than 200 new addresses have crossed this threshold.

#Bitcoin is undergoing a supply-crisis

Since the start of the year, 211 new Bitcoin whale addresses with 1,000 BTC or more were created. However, Bitcoin supply on exchanges is at its lowest level in almost 2.5 years. pic.twitter.com/6TIuiXvXlj

This supply crisis is reflected in the steady decline of Bitcoin held on exchanges from the beginning of March 2020 until now. According to records from CryptoQuant, the total BTC on exchanges stood at 2.3 million as of Feb. 6, 2021. This indicates a significant decline since the beginning of the year.

BTC Reserve in Exchanges: CryptoQuantConversely, its price action has continued to show no signs of weakness. The daily chart from TradingView indicates that BTC has recorded a 35% increase since the beginning of 2021.

This rally briefly pushed BTC to an all-time high above the $41,000 price mark on Jan. 8. Since then Bitcoin has been consolidating between $30,000 and $40,000.

The number of active addresses has also joined the long list of metrics adding credence to the asset’s bullishness. Statistics from Glassnode show that existing BTC wallet addresses recorded a new peak at 1.34 million. This figure surpassed the 1.28 million peak saw during the bullish mania on Dec. 14, 2017.

Active addresses: GlassnodeHistorical records have shown that the Bitcoin price and the number of active wallets are directly correlated. This may suggest that there are still higher price targets for the cryptocurrency to hit.

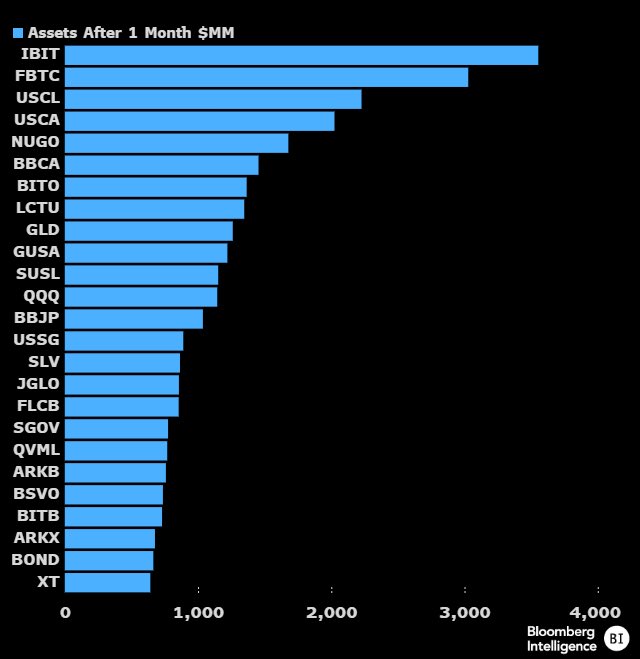

The Institutional EffectThe seemingly endless interest from institutional investors in Bitcoin is a significant factor responsible for this supply crisis. According to a BiC report, Emerald Mutual announced that it held more than 78,000 shares of Grayscale Bitcoin Trust (GBTC).

Similarly, Rothschild Investments recently joined the growing list of corporate investors, admitting to owning BTC worth $1 million.

Over time, GBTC has become the largest exchange-traded fund (ETF) for Bitcoin. Most institutional investors have exposed their portfolio to the digital asset without facing regulatory hurdles through this means.

Records from the Bitcoin Treasuries reveal that GBTC controls more than half of all digital assets under company custody. The firm currently holds 649,130 BTC under its management (~$25.3 billion) at press time.

The post Bitcoin Whales Increase Their Stake as Exchange Reserves Shrink appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|