2024-9-2 06:50 |

Bitcoin (BTC) is trading below US$58,000 having started the week above US$64,000. BTC is now down ~-10.2% in the last 7 days following a wave of sell pressure. Between August 6th and August 26th, the price of BTC rose from trading for ~US$49,800 to around ~US$64,700, a rise of ~29%. With traders still uncertain about BTC’s potentially volatile future, many appear to have chosen to cash out after a profitable period.

The Bitcoin price is down over 10% in the last week. Source: Brave New Coin Bitcoin Liquid Index

There have been noticeable outflows across US spot Bitcoin ETFs suggesting funds and asset managers have sold out of positions in the last week. There have been 4 consecutive days of outflows between the 27th of August and the 30th of August. The 30th of August was the largest day of outflows, with US$175.67 million flowing out of the 11 spot ETFs available on the US market. The largest and most popular ETF in the market, Blackrock’s IBIT product, observed outflows of ~US$65 million on the day, while Grayscale’s GBTC had outflows of ~US$70 million. The 4 days of outflows came after 8 days of positive inflows.

Traders will now look to the upcoming Non-Farm payrolls report to trigger a return to bullish momentum. This employment report, released on the first Friday of every month, is viewed as a key indicator of the US economy’s health. If this report is hot and indicates the US job market is growing quickly, then it will put more pressure on the Federal Reserve to cut rates and shift towards encouraging investment and consumption.

Last week Fed Chairman Jerome Powell’s comments at the Jackson Hole Symposium, where he suggested a rate cut would likely be coming in September, was a strong bullish trigger for Bitcoin price activity.

Institutional Digital Asset trading firm QCP Capital, however, is skeptical that a strong non-farm payrolls report will be enough to push the price through key price resistance levels. They explain in a message to their Telegram followers— “With the recent macro news proving to have little effect on the crypto market, we believe BTC is likely to remain range-bound within 58k-65k in the short term as the market awaits positive catalysts to break out of this range.”

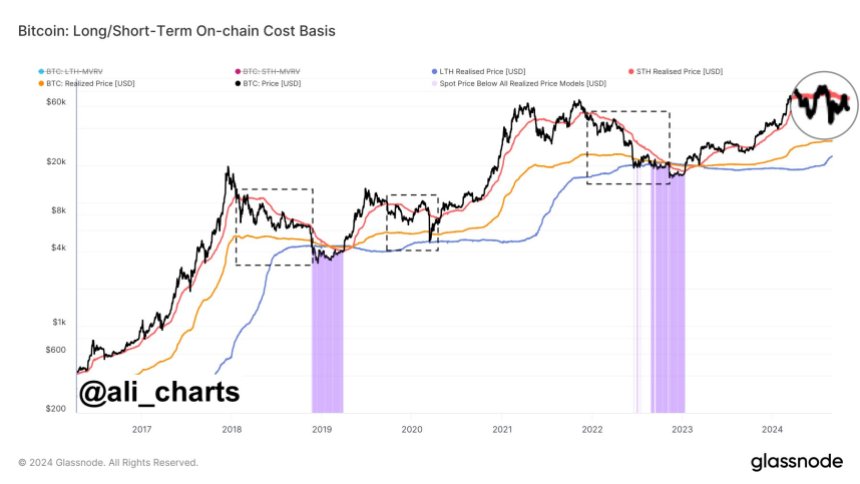

What can Bitcoin’s historic September price action tell us?Glassnode’s recent weekly insights reveal that Bitcoin now commands a dominant 56% share of the entire crypto market capitalization. This impressive figure is largely attributed to the unwavering confidence of long-term holders, who continue to amass BTC despite market fluctuations.

Data from Coinglass shows Bitcoin has only provided a positive return in September three times in the last 11 years. Source: Coinglass

September’s Bitcoin Bullrun: A Historical Perspective

Data from Coinglass highlights that Bitcoin has only managed to deliver positive returns in September three times over the past eleven years. This month has traditionally been challenging for Bitcoin, often influenced by market behaviors such as profit-taking after summer gains and the general volatility that tends to spike during this period.

The broader trend shows that while September is frequently a down month for Bitcoin, it also serves as a strategic period for accumulation. Historical data suggests that October has provided positive returns nine out of the last eleven years, presenting a potential opportunity for investors to capitalize on Bitcoin’s cyclic nature.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|